INMA Satisfying Audiences Blog – March 2019

By Matt Lindsay

This blog post is the third in a series on Key Performance Indicators (KPIs) that are helpful for media companies and other subscription or membership-supported organizations. The first post was about Total Customer Lifetime Value (TCLV), and it can be found here. The second post was about Core Relationships, and it can be found here.

Renewal Price Increases – Time is on your side

Mather Economics has long-term relationships with many of our News media clients going back ten years or more. We have observed the dramatic change in revenue streams as advertising has migrated from print to digital platforms and digital news products have been created and sold to subscribers. Through the prism of this experience, we have developed several KPIs specific to renewal price changes that measure the effectiveness of a pricing strategy and campaign.

These renewal pricing KPIs include incremental stops, net incremental revenue, reverts above and reverts below, and upgrades/downgrades. Another important metric we have developed is the ratio of the net and gross rate changes. In other words, the realized price increase on those customers that are remain active following the pricing action divided by the gross price increase applied to those customers. As an example, if a publication gave their subscribers a US$1.00 per month increase and the remaining customer’s average rate increased US$0.80, the ratio would be $0.80/$1.00, or 80%. We call this metric Yield.

Mather offers a dynamic subscriber renewal pricing service called Market Based Pricing. The goal of this service is to improve the economic efficiency of renewal pricing by a) increasing the revenue generated from subscribers with high demand for the product, and b) decreasing volume loss by avoiding aggressively pricing subscribers with higher sensitivity to price. The merits of Market Based Pricing in the publishing industry are well documented, with hundreds of publishers across the world having successfully implemented dynamic pricing strategies over almost two decades. It is typical for this type of pricing strategy to decrease price-related subscriber loss by 50%, which increases the yield of a renewal price increase substantially. In this era of increasing reliance on subscriber revenue, improving the performance of renewal pricing in generating revenue and minimizing subscriber churn is vital to the success of Publishers.

To support dynamic renewal pricing, Mather develops econometric models to estimate the retention propensity and price sensitivity of individual subscribers. We then recommend renewal rate adjustments according to the relative distribution of price sensitivity across subscribers in the market, and we validate the performance of the predictive models through A/B testing where a statistically representative control group of subscribers is excluded from the price increase. Comparing the performance of the test and control groups enables us to calculate the pricing KPIs described earlier.

We have found that tenure is an important predictor of price elasticity. The first year of a subscriber’s relationship with the publication is when they are most likely to stop due to a price increase. If they reach their third year, their renewal price elasticity will drop significantly. So, for publishers, when it comes to renewal pricing power, time is on your side.

Declining Yield

Yield has become an increasingly important key performance indicator (KPI) for our pricing programs. One key finding of our research, especially for those markets that have implemented several rounds of renewal pricing (both dynamic renewal pricing and standard, across-the-board pricing), is that the yield on renewal pricing generally declines with each renewal price increase. This is an intuitive result for many who have worked in audience and circulation groups, and this customer response should be anticipated when developing a pricing strategy.

To demonstrate this finding, the graph below from one of our partners illustrates that the average yield on pricing has gone from 79.2% during the first renewal pricing instance to 65.4% several years later during the sixth pricing instance. Importantly, the average stop rate over this same period declined significantly, the implication being that, while fewer subscribers stopped their subscriptions during a renewal pricing instance, fewer subscribers were accepting the full amount of the rate adjustment.

Yield Analytics

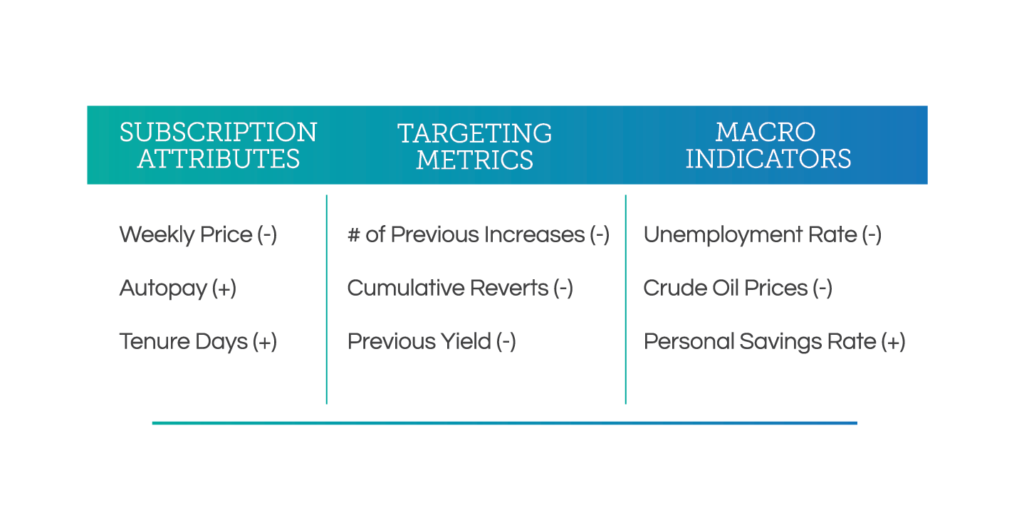

To understand the factors that affect Yield, our team ran hundreds of model specifications on a comprehensive data set including customer transactions and detailed performance results from prior pricing initiatives. We also included macroeconomic indicators to determine if the state of the economy influenced renewal pricing response. Some of those inputs are listed in the figure below along with their directional impact on yield. For example, we found that the yield on a subscriber’s previous pricing instance was negatively associated with the yield on their next instance, suggesting that subscribers who do not accept a price increase (but retain their subscription) will tend to similarly reject future pricing attempts. We also found that the presence of previous price-related customer service interaction (reverts) was associated with lower future yield on pricing. Finally, we found macroeconomic indicators to be significant predictors of yield, with higher unemployment and price levels in the economy being correlated with lower future pricing yield, while higher personal savings rates tended to improve future yield.

Bringing it All Together

Mather is continually working to improve subscriber yield management and renewal pricing processes for our Publisher partners, and we have incorporated our latest Yield prediction methods into our pricing recommendations. This synthesis of several analytical strategies, combined with other enhancements to our pricing services developed in collaboration with some of our partners, will be included in upcoming announcements. We are excited to share more details with you soon.

For link to main article, click here.