By Matt Lindsay, President & Arvid Tchivzhel, Managing Director of Digital Services

August 2021

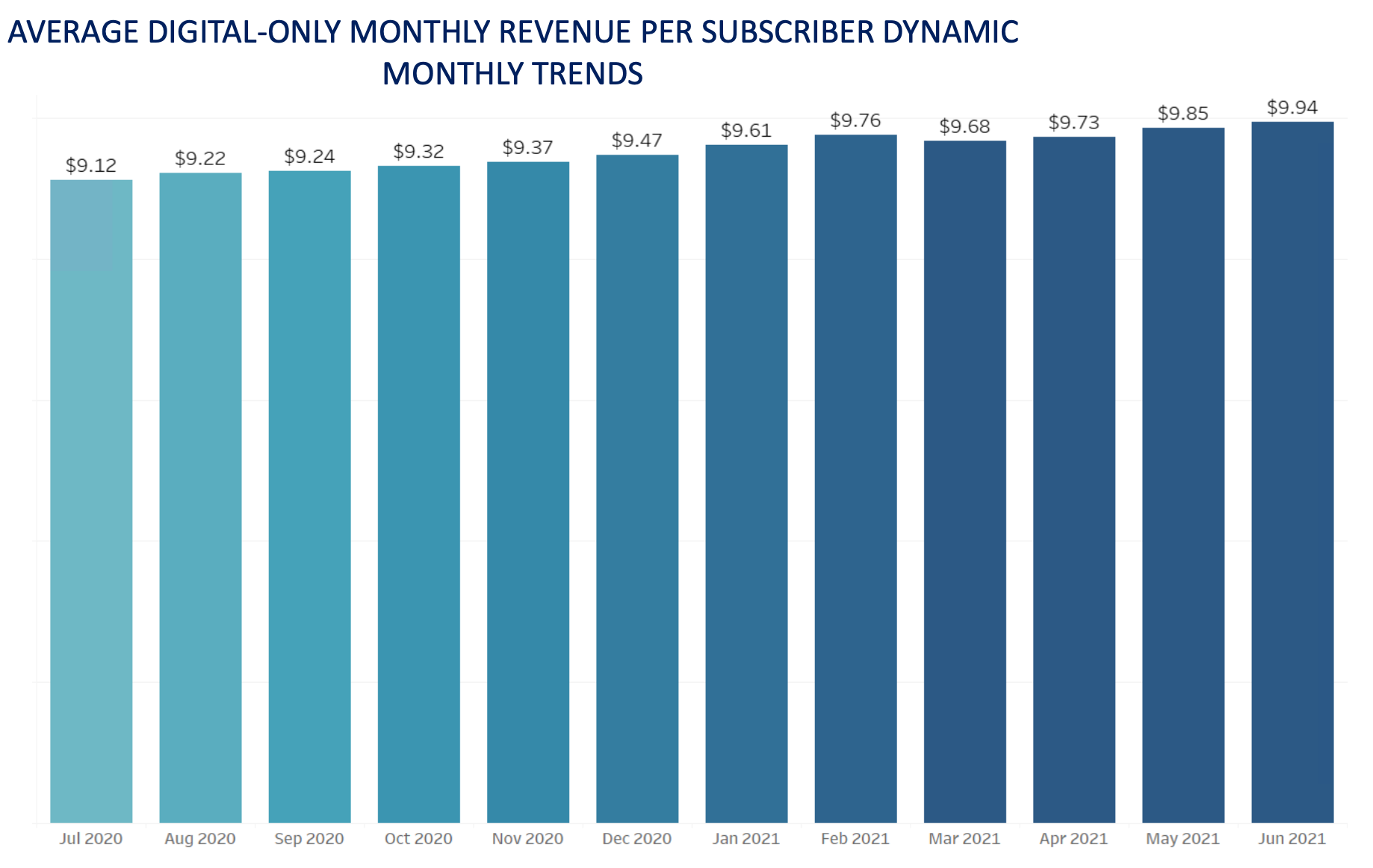

SUMMARY: The average digital-only subscription revenue per paid customer has grown 9% in the past 12 months.

Sustainable Digital Business Models for Newspapers

Newspapers are what economists call two-sided market firms. They attract an audience with original content, sell access to the content to their audience, and sell access to their audience to advertisers. The prices newspapers charge to each side of that market depend on the demand for their products to each customer segment. For a digital newspaper, those products are access to their content and advertisers’ desire to reach their digital audience.

Average subscription prices across all platforms have increased significantly — approximately 400% — in the past 15 years. Digital-only prices have increased about 9% in the past 12 months across all customers, including newly acquired customers on promotional offers.

The average digital-only subscription revenue per paid customer has grown 9% in the past twelve months.

What is the future business model of local, regional, and national newspapers? That is a complicated question, but we can offer a few insights into the potential of what digital revenue newspapers of certain sizes can expect. Metrics and benchmarks are available to illustrate how publishers are currently moving toward sustainable digital business models and the cost structures to fulfill their digital products and services.

Subscription revenue is the most common term for revenue received from visitors to a site, but reader revenue includes memberships, micro-payments, contributions, and e-commerce transactions.

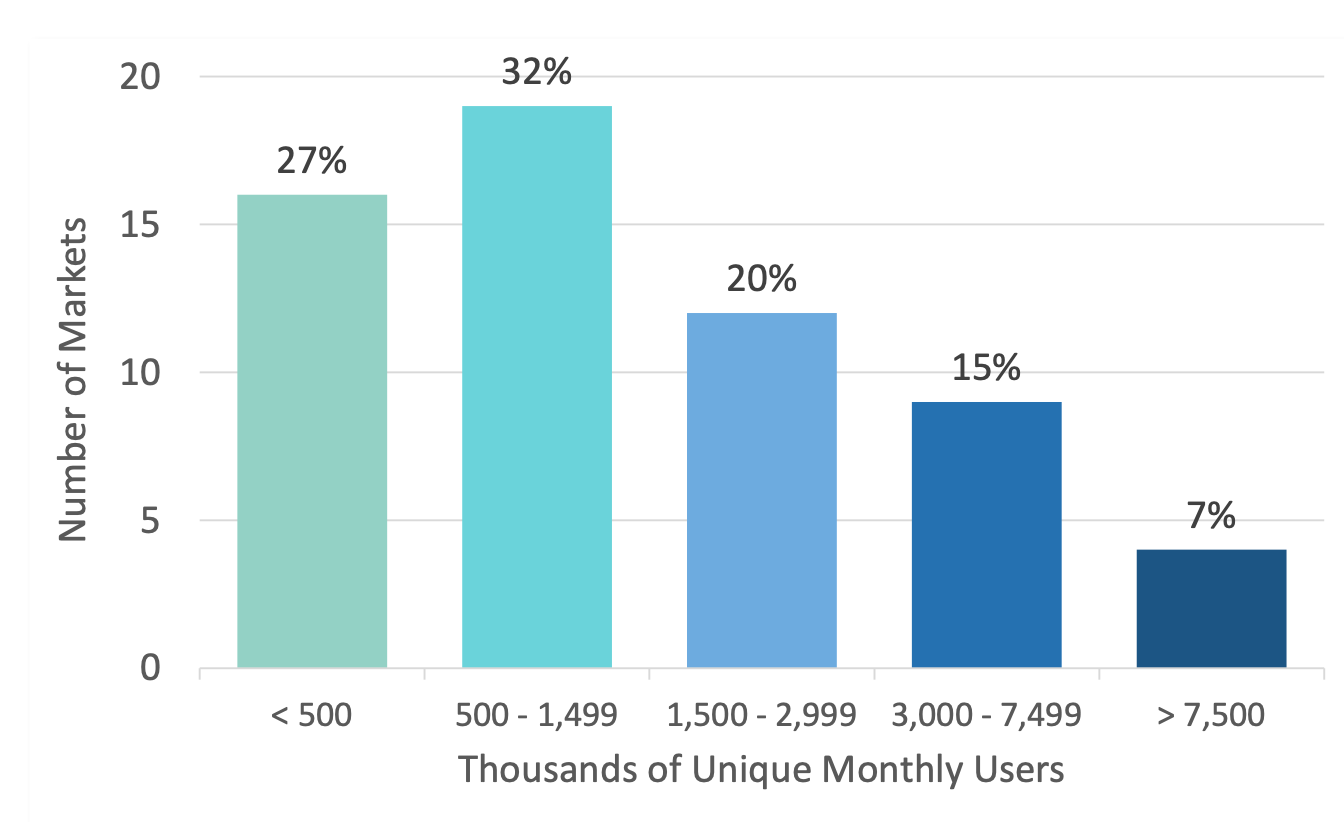

A fundamental metric for reader revenue is millions of unique visitors per month. At Mather Economics, we benchmark subscription starts from all channels per million unique subscribers per month. This metric can remove subscribers from the denominator, to make it millions of unique non-subscriber visitors.

The distribution of monthly unique visitors per month in our benchmarking database.

The median subscription starts per million unique visitors per month in our benchmark database is approximately 400, and the best-in-class publishers have more than 600. A newspaper with 1 million unique visitors would start about 400 digital-only subscriptions per month across all sales channels.

What is the potential for digital subscription revenue for a publisher with 1 million unique visitors? This depends on a few factors, including the maturity of the digital product, the saturation rate of digital subscriptions for that publisher, and the churn rate for digital subscribers.

A publisher’s saturation rate is defined as the percentage of its online audience that it can expect to subscribe to digital-only products. The New York Times has converted approximately 5% of its average monthly unique visitors based on publicly available data. Regional newspapers average about 1.5% of their digital audiences based on data from Listener, but they continue to grow this percentage over time, and we do not believe they are at their saturation levels.

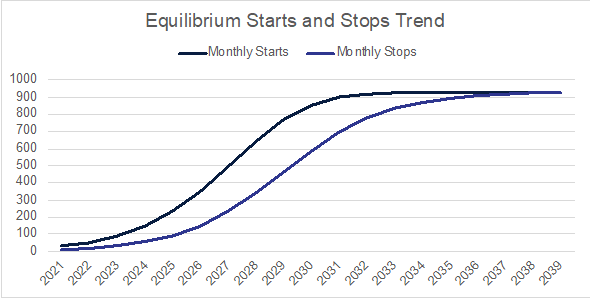

The number of digital-only starts will be large relative to the number of stops early in a publisher’s digital product growth cycle. The starts will exceed the stops until they approach the saturation level of subscribers, and then the number of stops will catch up to the number of new subscriptions. The graph below shows the annual digital starts and stops for a publisher with about 1 million unique visitors and a saturation rate of about 2.5%.

Annual digital starts and stops for a publisher with about 1 million unique visitors and a saturation rate of about 2.5%.

Increasing the equilibrium level of digital subscriptions can be achieved by expanding the reach of a publisher’s content or by raising the saturation rate through product innovation and development. Churn is also a factor, but it will primarily affect the speed a publisher reaches saturation.

The steep increases in news demand we observed in 2020 accelerated publishers’ growth in digital subscriptions, but it did not increase their equilibrium level of subscriptions if there were not sustained improvements in a publisher’s digital products or audience size.

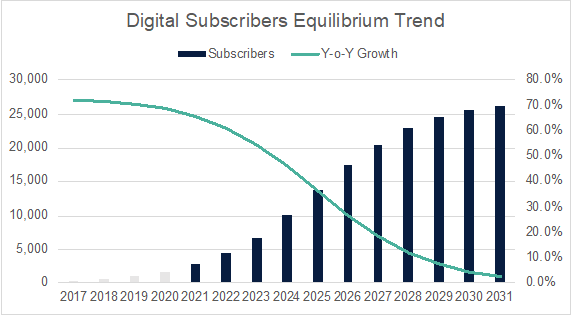

A plot of a publisher’s annual digital subscriptions and the year-over-year growth in subscriptions is below. This chart shows how a publisher reaches a 2.5% saturation rate of an audience of one million monthly unique visitors.

A publisher’s annual digital subscriptions and the year-over-year growth in subscriptions.

The potential digital-only subscription revenue for this publisher is about US$3 million per year if its average monthly revenue per subscriber is US$10 and it has about 25,000 digital-only subscribers.

A rough rule of thumb is that a publisher’s newsroom should be about 50% of its digital-only subscription revenue. In this example, that would be a newsroom budget of about US$1.5 million.

We are developing benchmarks on ratios of full-time newsroom staff per 1 million unique users. Early data points suggest current ratios are approximately one newsroom full-time equivalent (FTE) per 70,000 monthly unique visitors. This metric varies considerably and there are often part-time employees, freelancers, AP/Reuters reporters, digital editors, and many other contributors to fulfill the daily news cycle for a newspaper. For this example, with 100% of revenue being derived from digital-only subscriptions, that ratio would suggest about 14 FTE reporters for an audience of 1 million unique visitors per month.

This is a very brief discussion of a very complex topic and focuses exclusively on the digital-only subscriber revenue stream. Mather is working with publishers to optimize their digital operations to maximize digital revenue, both audience and advertising. There are many leverage points within a subscription business that can materially improve performance, and we will touch on these in the future.

Contact the authors to learn more about saturation, equilibrium, and how Mather can help optimize digital revenue.

matt@mathereconomics.com

arvid@mathereconomics.com