Mather Economics | Insights, News & Events

March 18, 2022

By Matt Lindsay, President, and Arvid Tchivzhel, Managing Director

SUMMARY: Though local newspapers will (and should) cover global events, Mather recommends U.S. local newspapers continue their existing paid content strategies oriented around local news.

Research shows difference in COVID, Ukraine news engagement

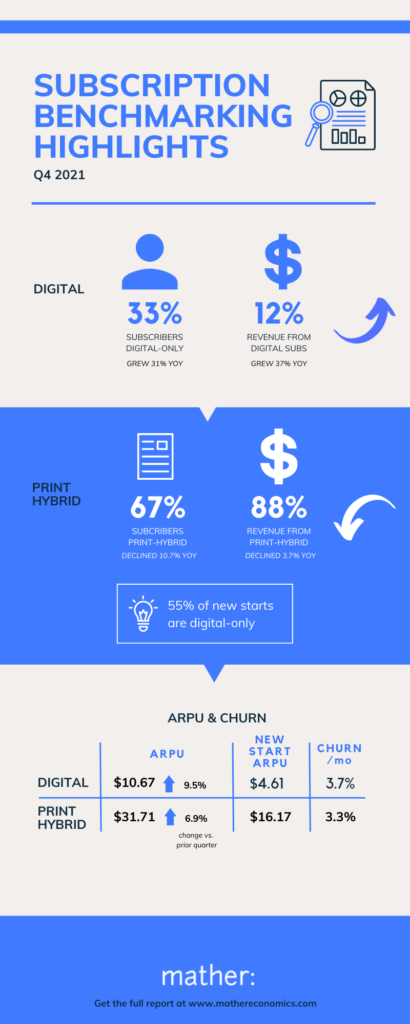

Mather Economics recently published its Subscription Benchmark Report for the fourth quarter of 2021.

The subscription benchmarking report includes metrics on all subscribers, digital-only, and print/digital hybrid, from 350 newspapers in North America. The digital audience benchmarking report shares metrics from 121 newspapers captured using the company’s Listener data platform. Mather clients are welcome to download the full report.

Mather’s subscription benchmark report highlights

Though digital volume continues to grow at a rapid pace, the growth has slowed and revenue growth lags volume due to much lower average revenue per user (ARPU) of digital-only subscribers.

Details for each of these metrics and many others are featured in our report by publisher size and geography. Mather clients can download the full report on our website.

Looking ahead, Mather Economics maintains a forecast of when digital subscriptions will exceed print subscriptions based on the trends observed in each quarter. We call this event the volume cross-over point.

Due to slowing digital-only start volumes in late 2021, which have reverted to their pre-COVID levels, our volume cross-over point is expected to be 2024 (revised from 2023). We will begin publishing a revenue cross-over point in upcoming benchmark reports. The digital-only revenue cross-over is expected to be several years after the digital volume cross-over due to the significantly lower average revenue per month for digital-only subscribers.

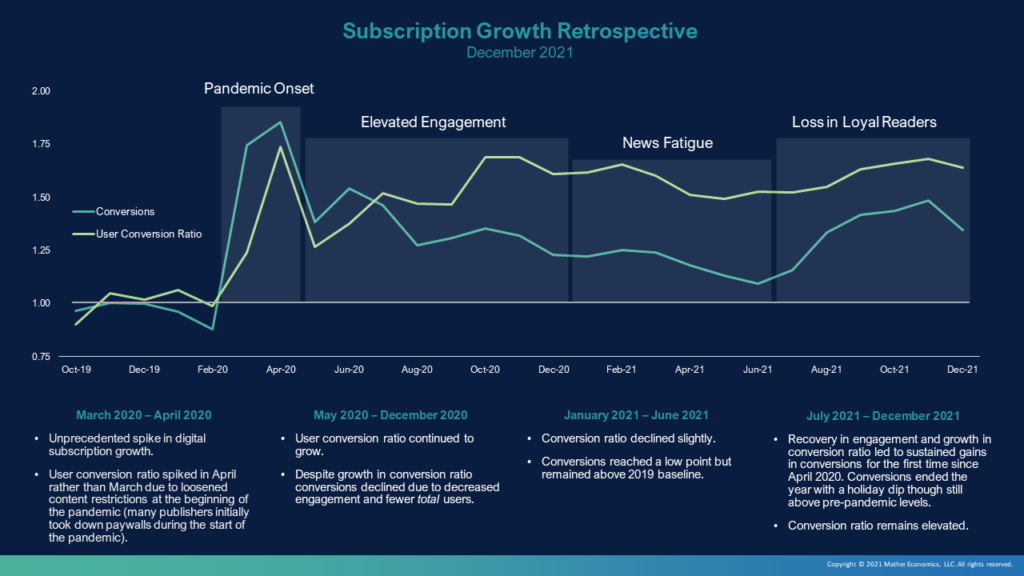

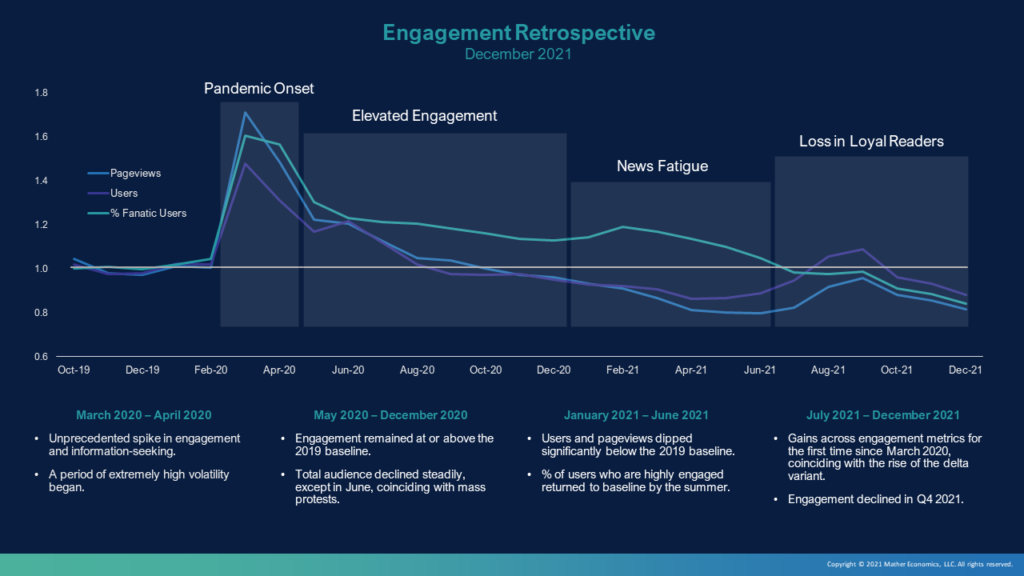

Two-year retrospective from the digital audience benchmarking report

March 2022 is the second anniversary of the disruption and news coverage of the COVID-19 pandemic. In our most recent digital audience benchmark report, our data scientists summarizes audience engagement and subscription impact across four phases over the last two years.

March 2020-April 2020: pandemic onset

- There was an unprecedented spike in engagement and subscription growth.

- Also, the user conversion ratio lagged due to publishers removing paywalls during the start of the pandemic.

May 2020-December 2020: elevated engagement

- During this time, total audience declined to 2019 levels but engaged users remained elevated. Total conversions followed the total audience trends though remained elevated.

- Also, the user conversion ratio continued to rise due to fewer total users but sustained engaged users.

January 2021-June 2021: news fatigue

- During this time period, total audience and engagement dropped below 2019 (pre-pandemic) levels. Total conversions reached the lowest point during the pandemic yet were still elevated compared to pre-pandemic levels.

- Additionally, the conversion ratio declined from earlier peaks.

July 2021-December 2021: resumed subscription growth from COVID variants and the loss in loyal readers

- During this time, there was a further decline in total audience and engagement with a temporary fall rebound. There was a temporary growth rebound in conversions (since April 2020), though it was elevated versus pre-pandemic levels.

- Also, the conversion ratio remained elevated on a smaller total audience.

Parallels between COVID and the war in Ukraine

As COVID coverage declines and war coverage escalates, we are seeing some parallels to how audience engagement and digital subscriptions are performing. Greg Piechota noted early observations from national media organizations and those based in the European Union indicate similar spikes in demand.

The differences between COVID and war news cycles are important to note, however. COVID coverage focused on how each community experienced a global pandemic. Readers within each state, county, city, and neighborhood sought insights about local cases and how elected leaders were responding with policy. The observed impact on engagement and subscriptions validated the value of covering local news and having reporters embedded in the communities being served.

By contrast, the Ukrainian news cycle is an international incident with readers turning to national news brands for insights and coverage as well as news brands based in the European Union.

Though local newspapers will (and should) cover global events, Mather recommends that U.S. local newspapers continue their existing paid content strategies oriented around local news. In our earlier work on content strategy and digital transformation with the Dallas Morning News, we found that local newspapers should not compare themselves to the New York Times when building a content strategy.

Except for national, European, or international brands, early data from Listener suggests engagement for U.S. local newspapers is not following the same trends as observed during the pandemic. Mather’s data scientists continue to analyze the last few weeks of content benchmarks and will publish updates as they are ready.

The Latest in Digital Audience Analytics and Upcoming Blog Posts

The past two years have seen rapid progress in the art and science of digital subscription sales. Since 2020, we observe many newspapers optimizing their ‘bottom of the funnel’ sales process. Emphasis for many newspapers is now on retention of digital-only subscribers and broadening the reach of their content to attract more readers. Using analogies to the sales process other than funnels (such as cyclones or ladders) is helpful in emphasizing the role of engagement in subscription revenue and retention.

Content analytics is the focus of recent innovations and applications of data science in news media. Mather is helping publishers optimize the value of each piece of content to their business. Our recent blog post on the relationship between lifetime value and digital-only subscription sales by content topic is an example of recent insights in this area. Dynamically selecting content for ‘premium’ (subscriber-only) status is one use-case where analytics is helping automate and optimize a process currently done manually by editorial staff.

Mather is also working with publishers to optimize their digital subscription offers and subsequent pricing strategies. The alternative strategies of very low-priced vs. moderately discounted offer terms have been studied, and the importance of the different market, audience, and product characteristics to the relative success of these strategies have been measured.

Please email us at matt@mathereconomics.com or arvid@mathereconomics.com if you would like to participate in our benchmark reports. These benchmark reports are free to clients of Mather Economics and data collection is automated. These reports are unique in their breadth and consistency of data across participating publishers. Non-clients can participate in these reports for a nominal fee. Mather is a data partner for North American Newspaper publishers with the Medill School of Journalism at Northwestern University for the Subscriber Engagement Index.

Ready to implement a Premium Content Strategy? Reach out to us, and Mather will share our results to date. Then, let Mather’s Premium Content Engine help identify which content is suited for premium.