Mather worked with a midsize winery located in Paso Robles, CA, and sought to optimally price a selection of SKUs in their portfolio that was to be released in Spring 2022, while also staying within their depletion, or “time to sellout” goals for each SKU.

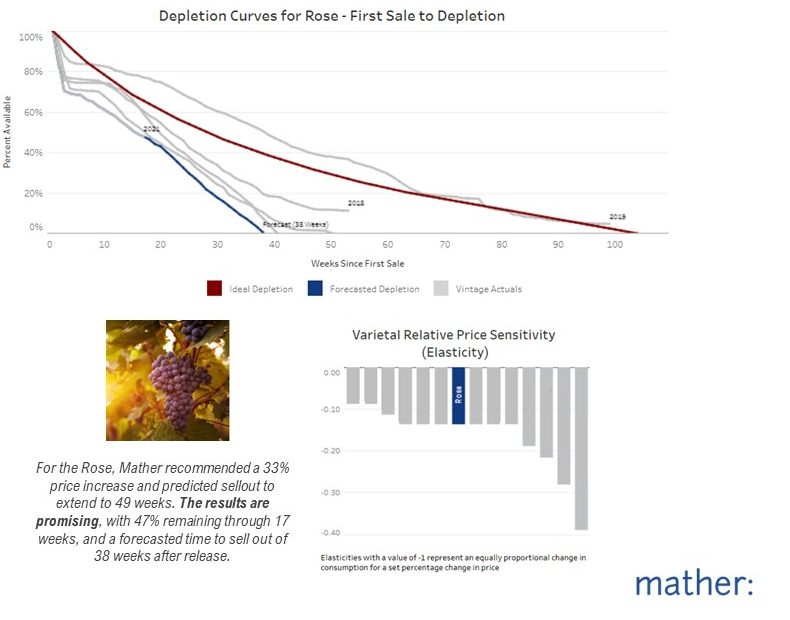

Mather cleaned ten years of historical sales data, built econometric models that estimated the price elasticity for each SKU, and used forecasting techniques to predict the time to sellout, given the estimated production, historical demand, and current price point of each SKU. Layering in price elasticity models allowed Mather to illustrate how changes in the price would affect consumer demand and time to sellout at the SKU level.

Mather delivered an executive summary, illustrating when we predicted sellout under current price points vs. other price points, along with revenue implications and a recommendation, operating under the client’s constraints/goals. Mather included summary statistics for each SKU to help the client better understand their portfolio in a centralized document.

INFOGRAPHIC

VIEW VIDEO

Discover How Mather Helps

Mather Economics works with the winery to more effectively use their DTC sales data to make intelligent pricing decisions, fully understand and optimize their inventory depletion and building stronger wine club churn reduction and acquisition campaigns. LEARN MORE ABOUT DTC SERVICES ![]()