Is your print pricing strategy too aggressive? Depends on your print runway.

INMA Blog

By Peter Doucette, Senior Managing Director, Strategy, and Matt Lindsay, President

September 29, 2022 | 3-min read

Some data indicates news publishers know they need to ease the pricing accelerator and elongate their print runway to fund their digital transformation.

Over the last few years, most U.S. newspaper publishers have been aggressive with print subscription pricing to combat revenue losses from declining local print advertising businesses.

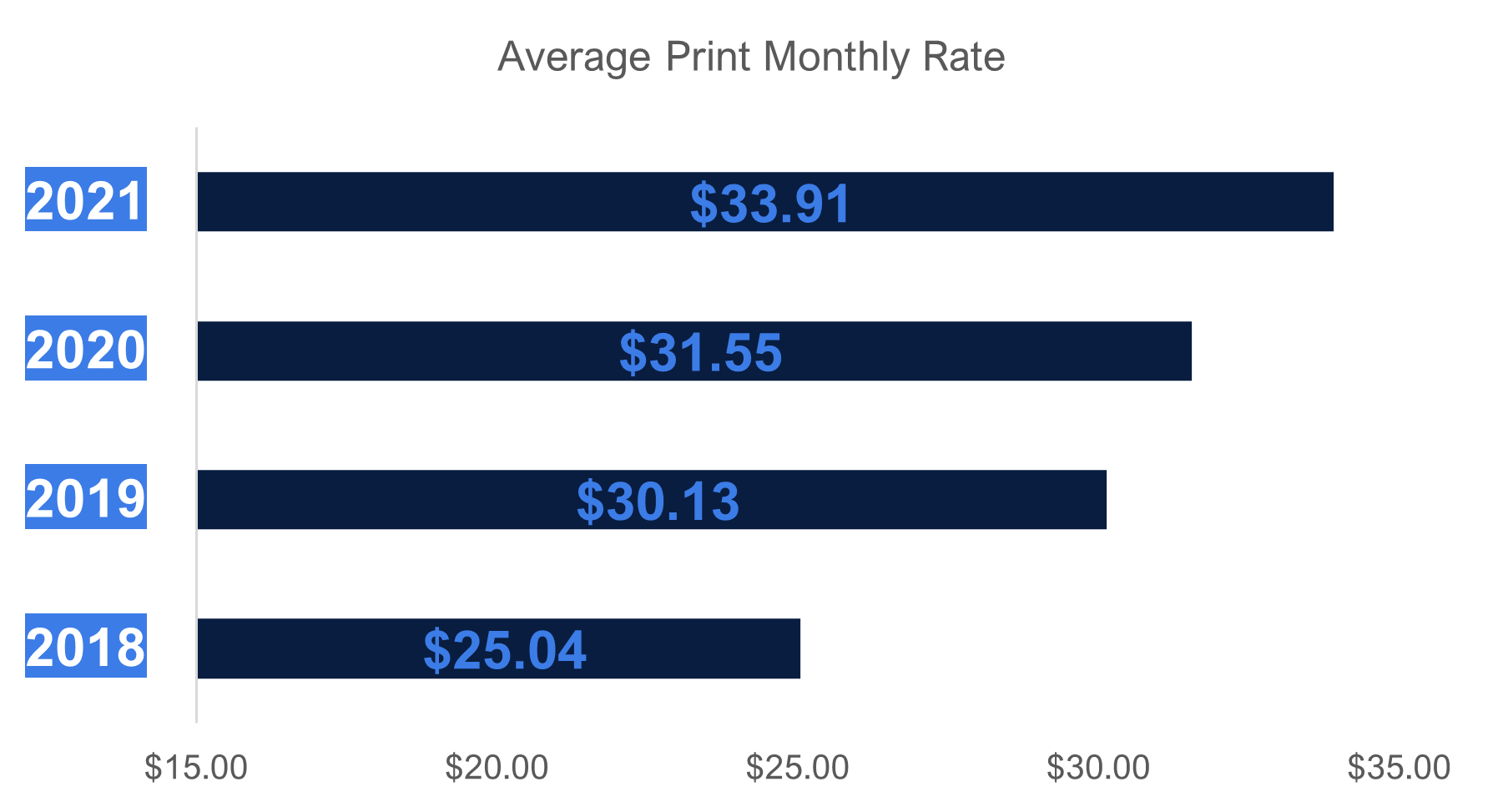

As you can see in the chart below, the average monthly rate for print subscriptions has grown significantly (7.9% compound annual growth rate [CAGR]) from 2018 to 2021.

But are publishers reaching a tipping point with print subscription pricing? Perhaps.

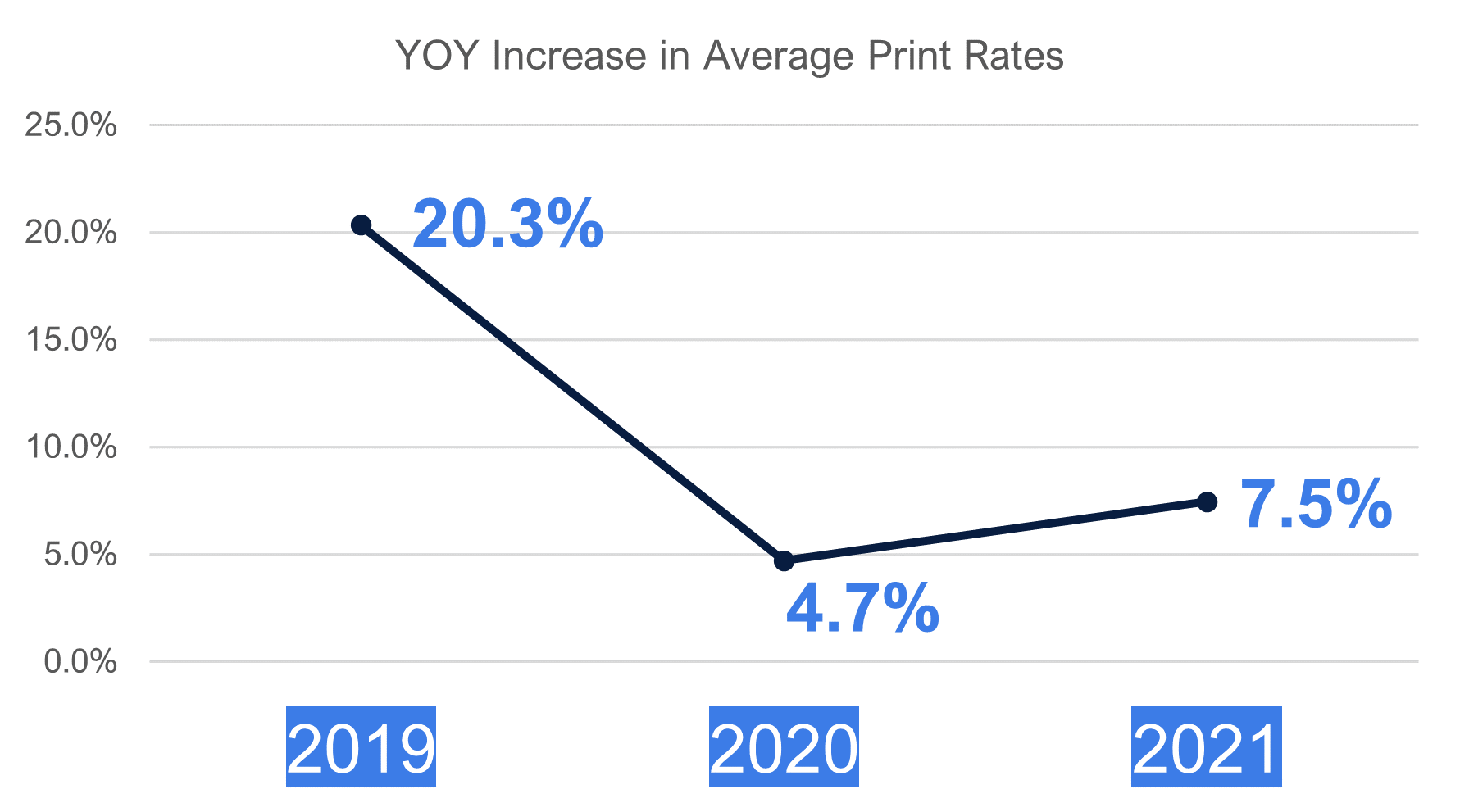

Monthly print churn rates have increased to 3.77% in the third quarter, up from 3.41% in the prior quarter. Also, if you look more closely at the pricing data, you will see that the average pricing year-over-year (YOY) growth rate has been much lower in the last two years than in 2019. This may signal that publishers know the need to ease the pricing accelerator and elongate their print runway to fund their digital transformation.

Strategic Decisions

Publishers face the dilemma of deciding how hard to push their print subscribers to maximize subscription revenue at the expense of potentially increasing the velocity of print circulation declines.

There are arguments for and against extending the print runway that publishers must try to resolve. In particular:

Shortening the runway (i.e., aggressive pricing path)

- There is a need for near-term revenue and cash flow to solve 2023 challenges.

- The carrier-based distribution model is under significant duress. With open routes surging around the country and competition for labor at an all-time high, how long can this be a workable distribution model for publishers?

Elongating the runway (i.e. ease print pricing)

- Macroeconomic conditions of continued inflation and potential recession may influence print subscriber price elasticity.

- Alternate distribution models are currently being developed, particularly with many publishers experimenting with the same-day U.S. postal service delivery of newspapers. This could result in a longer print runway and the ability to serve subscribers for years.

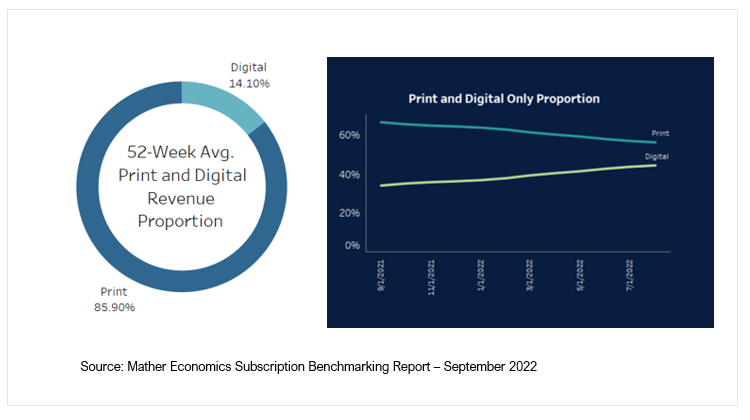

- The biggest argument for easing some on print pricing is that publishers need more time to become digitally ready. Mather forecasts the digital subscriber crossover point for the industry will be sometime in 2023, and digital subscription revenue is still less than 15% of total subscription revenue.

Moving forward

So, given all these headwinds and challenges, what path should publishers pursue with print pricing? The critical point is that publishers should take stock of their market conditions and digital readiness and be purposeful in managing print subscription pricing in the future.

Mather’s Market Based Pricing (MBP) is an excellent tool to maximize revenue while minimizing subscriber volume losses.

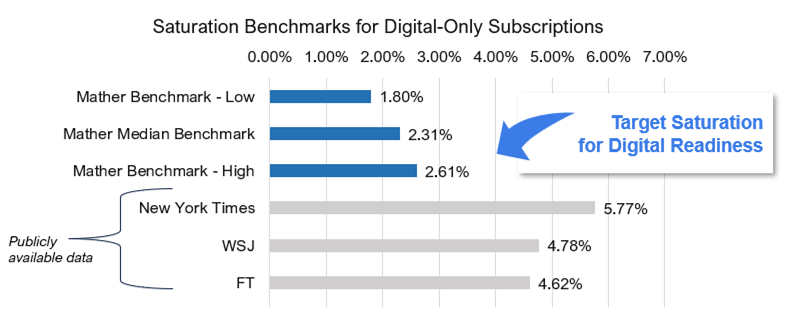

Publishers further along with digital transformation and with higher market saturation (perhaps at a level of 4% or more) can feel more confident and price aggressively. But for smaller news publishers with a limited digital scale, this is particularly challenging. The print product provides differentiation in a crowded media market, and erring on the side of elongating the print runway seems prudent. This approach also provides time to test the hypothesis of continuing revenue growth from digital subscriptions.

Mather’s Benchmark reports shed light on recent media trends, insights