By: Xavier van Leeuwe, Matthijs van de Peppel, and Matt Lindsay

Director of Marketing and Data, Manager of the Data Intelligence and Customer Relationship Management Team, and President

NRC Media and Mather Economics

Do you recognise this ritual? It’s July, and it’s pricing time. The CEO, CFO, CMO, and editor-in-chief are in a room once per year to discuss renewal pricing of subscriptions.

The CFO leads off: “OK, let’s start with our six-day subscription. How much did we raise that one last year?”

CMO: “2.3%.”

CEO: “What was the inflation this year?”

CMO: “2.1%.”

CEO: “OK, let’s do 2.6% this year. A little bit over inflation.”

The editor-in-chief joins the conversation: “No, I don’t like that. The yearly price would get above €400. Subscribers might stop for that reason. And besides that, our competitor didn’t raise that much last year.”

CFO: “OK, let’s do 2.2%, to keep the yearly price just under €400.”

CEO: “Agreed. Next product.”

In the meantime, the audience team is filling out the Excel files and sees millions of euros flying back and forth. Decisions about the future health of customer relationships and the future of our company are made in seconds, purely on gut feeling.

We never had a clue how these decisions would turn out.

How many subscribers would stop when we raised prices by 2.2%, or with a hypothetical 10%? Were customers really comparing prices with our competitors? Was our brand too weak to resist a lower price offered by our competition?

The inner workings of the pricing machine used to be a complete mystery to us until Mather Economics crossed our path, and then everything changed.

We were introduced to price elasticity analysis. The Mather Economics team explained to us that it’s possible to determine price sensitivity. With these tools, we can predict how many lost subscribers will result from any given price increase. And from that moment onward, the gut was not shaping our future: the data was.

Find your balance

Price elasticity analysis is an incredibly powerful instrument to help lead your business where you want it to go. When marketing teams understand the impact of prices, they can determine whether they want a lot of customers for a smaller amount of money per capita, or if they want to pursue a strategy with fewer customers who are each paying a lot more (or anything in between).

When it comes to analysing customers and their pricing on a personal level, we recommend marketing teams consciously make a couple of decisions that may touch upon the core values of the organisation.

First of all, what personal data is included in the models? Which skills can be outsourced, and which must be fostered in-house?

At NRC, we used price elasticity modeling to grow the number of relationships without declining in total margin. Since we are a newspaper company, we like to see ourselves as fulfilling a mission.

We are on Earth to stimulate development. We feel that our journalists balance the executive powers in our society. We can only fulfil this mission if there are enough people reading what we write. A hypothetical newspaper company with only one reader paying the entire yearly turnover would be financially healthy, but it won’t play a significant role in society.

Understanding the impact of pricing on a relationship can be used to make more money per customer. Sometimes this implies having fewer customers paying you more money, using large price hikes. Pricing analysis can also be used to prevent vulnerable customers from stopping after a price increase, thus obtaining the maximum amount of customers.

Therefore, internally we say to each other: Don’t break up over money.

Analyse real behaviour

In our experience, and somewhat contradictorily, it is not very helpful to ask customers what they would do at a certain price level or what price they think is reasonable. It appears that when it comes to the value of a certain product or service, customers are clueless (read William Poundstone’s Priceless for more on this subject).

Let’s do a mental experiment to illustrate this. Imagine you are walking through a flea market in an old European city, and you are attracted by a wooden lamp. It looks nice and has an artistic touch to it. The lamp would fit perfectly in your living room, so you walk up to the guy selling it.

Now imagine two scenarios:

- The guy tells you he just moved in with his girlfriend. The wooden lamp was in his dorm. He bought it five years ago at IKEA.

- He tells you the lamp belonged to an artist who just passed away. In his workshop, he had this wooden lamp from the 1950s, handmade by a famous Danish designer.

Most people end up paying a lot more for this lamp in the Danish designer scenario than in the IKEA scenario, despite the fact that the material, quality, and design of the lamp haven’t changed. These are the effects of mental accounting, extensively researched by Richard Thaler.

The only way to find out how people really respond to different price points is by testing in real life. It is ideal to use control groups, which receive no price increase, compared to others that do. By measuring the difference in lost customers between the control group and the others, it is possible to define the impact of price changes for different customers and different products.

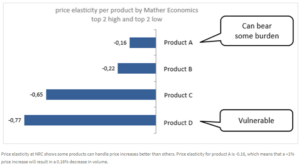

What we found at NRC was remarkable. Different forms of subscriptions turned out to have huge differences in price sensitivity. For some products, a small increase caused a tsunami of extra cancellations. On the other side of the spectrum, there seemed to be products where double-digit increases didn’t have any effect on retention.

This information gives fantastic insights about the exact value customers attach to your product. This is quite spectacular, because those same people would not have been able to tell you if you asked them.

Increase prices with minimal strain

In almost every recurring revenue-based business, price increases every once in a while are inevitable, because costs increase due to inflation. At the same time, an increase in subscription price can be a reason for customers to stop their subscriptions and leave the company without any income from those people.

Every company with recurring income should pay a lot of attention to finding the balance between increasing prices and, at the same time, preventing customers from stopping their subscriptions. Price elasticity analysis does exactly that.

When we got insights on the price sensitivity of subscribers, we were able to adjust prices to protect the financial health of the company, but with a minimal impact on the number of relationships. We increased prices with minimal strain on groups of vulnerable customers, while the ones who could bear some burden had their prices increased accordingly. In this way, pricing analysis did a great job in preventing “break-ups.”

Taking this to another level

Being as smart as you are, you are probably connecting some dots right now. When you get granular and start analysing pricing, in theory it’s possible to define prices on an individual level. This would give you even better results, because in the end, no two customers are the same.

The decision on whether to differentiate pricing by customer, product, or any other metric is up to each organisation. NRC does not vary pricing by individual customer, but Mather Economics works with many organisations that successfully employ that strategy.

How understanding price elasticity generated US$10 million

Consider a large U.S. publisher Mather recently worked with. This company needed to increase audience revenue without increasing customer churn. It had annual price increases and wanted to understand price elasticity across its customer base to improve future yield.

Mather Economics estimated price elasticity using econometric models and developed a test-and-learn process using A/B testing, where two versions (A and B) are compared. The versions are identical except for one variation that might affect a user’s behaviour, thus hinting to an optimised outcome.

We developed survival models (which predict retention of customers over time) using past customer behaviour and estimated price elasticity for the publisher’s current customers. We selected accounts for the target and control groups, suggested prices on a per-customer basis, tracked customer behaviour, and reported the weekly performance of the groups.

The test results showed significant differences in price elasticity existed within the customer base. Important factors for predicting individual customers’ price elasticity were their tenure, digital engagement, and product mix. Demographics, acquisition channel, geographic location, and several other factors were also found to have significant effects on price response.

The A/B test results validated the econometric model predictions. Applying these insights to the annual price increase process improved the yield by 40% — approximately US$10 million per year.

For full article, click here.