September 20th, 2016

By: Matt Lindsay and Patrick Tornabene

President of Mather Economics and Vice President of Audience Development & Analytics at Newsday

Matching analytical insights with operational improvements is where art meets science in many businesses. Just as composing requires different-yet-related skills to performing music, operationalising analytical insights requires an innovative perspective supported by technical knowledge.

In the multi-year collaboration between Newsday and Mather Economics, we have found a few opportunities for significant business improvement using a combination of analytical insights and operational improvements. We believe this type of innovation is where many publishers must excel to succeed in the coming years.

The first category of innovative applications of analytics falls under the general term churn modeling. We found that many lost subscribers could be identified in advance of the end of their subscription.

The more difficult challenge was what to do with the information once we knew who were the likely subscribers to stop. At several of Mather’s clients, and at Newsday in particular, the management team has found creative ways to apply this information to their audience operations to reduce churn.

Dynamic messaging for payment deviations is one of the biggest successes. In this case, the communication sequence and messages during the renewal process were triggered by deviations from prior payment behaviours — instead of a generic collections communication sequence applied to all subscribers.

Through analysis of prior payment patterns, each subscriber was assigned an average pay date and standard deviation. These patterns were durable over time, and they were likely due to the timing of the renewal bill and the customer’s monthly bill-paying routine.

If a habitually late payer that always paid 10 days after the due date was seven days late, they were not messaged; but if a habitually early payer was seven days late, they received a message.

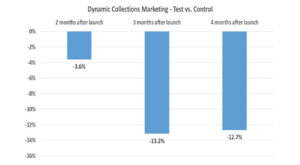

This seemingly minor adjustment in messaging during the collection process lowered churn by 13% three months after launch of the programme, compared with a control group that received the standard communication sequence.

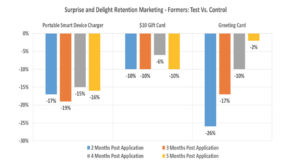

Another outcome at Newsday was that we successfully used analytics to develop “surprise and delight” retention marketing campaigns that lower churn. Three different retention incentives were offered to subscribers that were found to have higher propensity to churn.

The campaigns tested were: a portable smart device charger, a $US10 gift card, and a thank you greeting card. Each campaign lowered churn for a different duration following the campaign.

The greeting card had the greatest short-term effect in retention with the quickest decline in effectiveness. The charger and gift card had more permanent effects on retention. Using costs of the incentives and further segmentation of the audience, the optimal strategy for each customer group can be identified.

In a follow-up test, the “surprise and delight” retention marketing campaigns were tested on subscribers observed to have accelerating churn scores, meaning their churn risk increased from one month to another. In these cases, the reduction in churn was much greater than the effect on high-churn customers that did not show increasing churn risk.

Other applications of churn-risk modeling that have been successfully implemented are niche product opt-ins and content previews. In both cases, subscribers felt these campaigns increased the value of their relationship with Newsday and decreased their likelihood of stopping their subscription.

Besides churn modeling applications, Newsday has used operational data to identify differences in call center representatives’ effectiveness. They found the amount of revenue negotiated by call center representatives was in the millions of dollars annually, and that individual representative performance varied by as much as US$200,000 per year.

Having the data on performance by individual representative enabled Newsday to experiment with alternative retention offers and identify best practices for negotiation and retention. These changes have improved the realisation of revenue from price changes by 11% quarter-over-quarter.

There are many other successful ways to use data insights. Growing experience with learning and testing has fostered other ideas for applying insights at Newsday, and the following are currently in development:

- Dynamic and personalised onboarding and engagement processes.

- Personalisation of products.

- Audience data incorporated into content programming and digital advertising rates.

- Digital subscription conversion optimisation.

Having the ability to capture data, analyse the data, and identify customer behaviours or preferences is vital for successful business improvement. Technologies and skill sets that enable these activities get much attention and investment.

An underappreciated but equally important capability is the tried-and-true management skill to design, implement, and successfully execute strategies supported by data. That is where tomorrow’s leaders will excel, and what we are excited to see at Newsday.

For full article, click here.