By: Xavier van Leeuwe, Matthijs van de Peppel, and Matt Lindsay

Director of Marketing and Data, Manager of the Data Intelligence and Customer Relationship Management Team, and President

NRC Media and Mather Economics

Digital publishing is a tough business. Monetising content is done through the dual streams of advertising and audience revenue, but middlemen and platforms have disrupted both revenue categories with each new entrant to the value chain claiming their piece of the digital revenue pie.

The question facing publishers is how to maximise total revenue from their digital distribution channels across both primary revenue streams. An important tool available to publishers trying to answer this question is dynamic customer lifetime value (CLV) scoring.

CLV is an old concept. Calculating the expected operating margins received from a customer was done long before the birth of the Internet.

For a digital publisher, measuring CLV requires knowledge of the revenue received from a customer and the revenue received from advertising delivered to that customer. In most cases, the direct costs for a digital customer are close to zero, thus digital CLV is really a revenue measurement and active lifetime forecasting exercise.

Where most digital publishers run into trouble calculating CLV for their audience is obtaining data on both revenue streams for each customer and forecasting a customer’s active lifetime. Let’s talk about the data challenge first.

Just the facts, ma’am: the necessary data

Digital advertising revenue data typically comes from the advertising server and the billing system. Many publishers use Google’s DFP advertising server to deliver digital impressions and their DART sales manager (DSM) to record revenue.

Other ad servers and billing systems are similar in their capabilities. The growth of programmatic channels and native advertising have made collecting accurate advertising revenue difficult, particularly at a customer level. The data on digital impression delivery is organised in a manner consistent with how the impressions are sold and delivered.

Digital audience traffic data often comes from Google Analytics, which has both a paid and free version. Omniture is another common source for digital audience traffic data. The data from both of these products are organised by how the site is tagged, which is rarely consistent with the way the advertising data is structured.

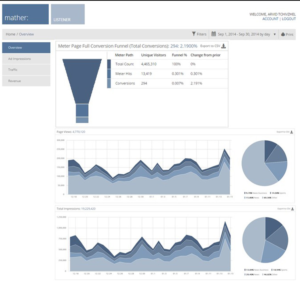

Merging data from these sources often requires aggregating both data sets to a common level of reporting, often to the day — not a very granular level for analysis. To address this problem, Mather Economics has developed a tagging system that captures all the data needed for CLV and other analysis for each unique visitor. We call this product ListenerTM.

“Prediction is very difficult, especially if it is about the future.” – Niels Bohr

The second challenge for measuring digital CLV is forecasting the expected active lifetime of a subscriber. In many cases, publishers use historical retention as a guide to future behaviour. A best practice is to develop a forecast of active lifetime by customer.

At Mather Economics, we use survival modelling, an econometric technique developed in the healthcare field, that can adjust active lifetime forecasts for subscribers in response to changes in factors that affect retention, such as price changes, retention campaigns, and product enhancements. If a CLV score is calculated using a forecast algorithm instead of a static historical retention curve, we call it a “dynamic CLV” score because it can adjust expected lifetime due to the factors mentioned above rather than be static.

Another predictive model that is helpful is a propensity to subscribe score for prospective customers. There are several approaches to propensity models, including machine-learning models and a field of econometrics called discrete choice models. These models can incorporate many types of data, including the time of the offer, the platform the customer is using, the type of content they have read, their geographic location, and the price of the offer. Mather Economics uses both types of modelling with a slight preference for econometric approaches.

Go forth and conquer

Once a digital publisher has an effective CLV metric in place, it can maximise the effectiveness of its customer acquisition efforts through an intelligent paywall. These models move away from a “one-size-fits-all” paid access model to a targeted acquisition strategy. Those prospective customers with high advertising revenue and low propensity to subscribe can be handled differently than an individual with a high likelihood of subscribing and low expected advertising value.

Other factors that are relevant for the intelligent paywall are the advertising demand for certain times of day and audience segments, which are not customer-specific.

An example of the math and how it is applied

To walk through a sample CLV calculation, let us evaluate the revenue from a non-subscribing visitor that reads an average of 50 article pages a month, each with four advertising positions at an average eCPM of US$8.00. This visitor is generating US$1.60 in digital advertising revenue per month (50*4*$8/1000).

If this publisher limits access to 20 articles per month and charges US$9.99 for monthly access, it is putting 120 advertising impressions at risk, or US$0.96 per month. If there is a 3% conversion rate for subscription offers at a 20-article level of free access, the publisher is putting US$0.96 in advertising revenue at risk for US$0.30 in expected monthly subscription revenue (US$9.99*3%.) We can add a time dimension to this analysis by estimating how many months of active subscription life this publisher can expect from the subscriber versus how likely the non-subscribing reader is to continue coming to the site in the future.

To illustrate an application of CLV by a publisher, we can review the case of a digital publisher in a major metropolitan market in the U.S. with two Major League Baseball teams. This publisher has a large digital sports audience, and we helped it evaluate the potential for a digital sports content product.

We found the audience was large enough to support a digital sports product as an add-on to its core publication. The most interesting finding from the project was how much the expected revenue from advertising and subscriptions differed for the fan bases of the two baseball teams. The different revenue economics determined how much content should be offered to each group for free to maximise total digital revenue.

One of the teams had a digital audience that was largely national in its distribution while the other team’s digital audience was almost exclusively local. From an advertising revenue perspective, that meant the team with a local audience generated much more traffic that could be sold through the direct sales force to local advertisers at higher eCPMs. The other team received about half of its digital traffic from fans living outside the local metropolitan area, which was sold through programmatic channels at a lower eCPM.

From an audience perspective, the team with the national audience had a higher propensity to subscribe, in part because the out-of-town audience was eager to have access to the coverage and in part because readers were outside of the print distribution area and their local sports coverage likely does not cover this team in detail. This audience also had demographic characteristics that were found to be indicative of subscription buyers.

The other team’s fans could read the coverage through the print platform or through other local coverage, so they had less demand for access to digital coverage. Also, they tended to have characteristics indicative of a group less likely to subscribe, such as a younger age profile and a greater share of mobile content consumption.

So, how does CLV help this publisher decide what to do?

The CLV calculation demonstrated that fans from the team with a more local audience should get more free content than fans from the team with a more national audience. We found that the opportunity cost of lost advertising revenue from a more restrictive access policy to the local audience outweighed the likely additional subscription revenue that would be realised. The opposite was true of the more national team’s audience.

Of course, the level of free access to the sports content is not set by team affiliation. It is possible for this publisher to determine the level of free access to this enhanced sports coverage for each unique visitor (grouped into segments) and for the level of free access offered to be a function of whether the visitor is in-market or out-of-market, what platform he/she is coming from, overall digital engagement, and other characteristics.

The revenue-maximising level of access can also be determined by what the likely retention would be once acquired as a subscriber and how the visitor would likely react to future price increases once he/she reached the end of the promotional offer.

A dynamic CLV calculation is a robust analytical approach for making profit-maximising strategic and tactical decisions. The incremental profit created by these decisions should yield a substantial return on the investments in data and analytics, particularly dynamic CLV scoring, made by digital publishers.

For full article, click here.