August 03, 2020

Featured on INMA.org

By Arvid Tchivzhel, Managing Director of Digital Services

By Matt Lindsay, President

Since the emergence of the COVID-19 virus and subsequent economic disruption, Mather Economics has published monthly benchmarks for the industry using our proprietary Listener data platform. Each of our clients receives a customized benchmark report, and we have summarized the industry metrics here for the INMA audience.

Listener data was designed specifically for digital audience analysis. Listener data is not sampled or aggregated prior to reporting, and historical data is available for at least 13 months. These data enable publishers to observe precise changes in audience behavior, develop predictive analytics not possible with other data sources, and implement business tactics supported by insights derived from those analytics.

Highlights from the benchmarks:

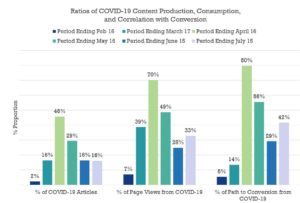

- In the most recent 30-day period, content explicitly tagged as COVID-19 that appears on the path to conversion for new digital subscriptions increased month-over-month to 42% in July from 29% in June, but it is below the high of 80% during the April period.

- COVID-19 articles produced has stabilized in the last 60 days at 16% of all articles from a high of 46% during the April period.

- We observed the impact of COVID-19 content on the path to conversion and engagement mirrors the pattern of new COVID-19 cases in the United States and other regions.

Other key observations from the July data:

- New conversion growth is past its peak and slowly trending down toward March levels.

- There continues to be relative growth in subscriptions compared to February.

- Fanatic and known users have stabilized since May, suggesting sustained growth in engaged and high propensity users.

- The number of users hitting the paywall is only 4% higher than February levels, suggesting non-paywall channels are key for subscription growth.

- The conversion rate improved from the influx of fanatic users as well, making the paywall more effective.

Digital subscription risks for the latter half of 2020 can be summarized in four areas:

- Conversions and conversion rates have declined relative to the peak April months. We expect the downward trend in conversions to continue unless publishers apply creative sales tactics, such as even more attractive introductory prices extend offers or registration walls.

- Fanatic (high-propensity) users appear to be stable throughout the summer, though risk of decreasing subscription starts remains if engagement drops to March levels and the pool of high-propensity users decreases.

- Churn from new subscribers if engagement abates and content preferences will continue to change following the initial COVID-19 period.

- There is uncertainty for U.S. publishers with a “second wave” of COVID-19 cases and impact on subscriptions. The recent surge in cases has caused an increase in pageviews and path-to-conversion for COVID-19 coverage, but “virus fatigue” could decrease interest in this content, diminishing the same bump in conversions observed in April.

Key focus areas for the next few months will be:

- Top-funnel and mid-funnel tactics: COVID-19 attracted a high number of new users and engaged existing users enough to migrate them to fanatics. Publishers need to move readers down the funnel so they can be converted to subscribers.

- Refining new subscriber onboarding and developing targeted retention and pricing tactics based on content preference and engagement level.

- Bottom-funnel tactics can be simplified: Keep a tight metre (or high levels of premium content), experiment with personalization in the call-to-action, and test post-promotion price and the effect on customer lifetime value.

Mather Economics will continue to monitor and publish industry trends, case, studies, and recommendations during the COVID-19 pandemic. We are available for any questions regarding these data or insights.