By: Madelin Zwingelberg, Senior Manager and Matthew Lulay, Managing Director of Consulting Services

August 2020

DOWNLOAD PDF

The economics of profitably printing and delivering newspapers has become increasingly challenging over the past several decades, but the COVID pandemic has greatly accelerated the need for publishers to evaluate alternatives to their current business models, including the reduction of print service days. The pandemic has led to varying impacts on publishers, but the prevailing themes are well documented: increased consumption of online content, a reduction in print attrition, and most impactful is a dramatic drop in print and digital advertising demand. Most publishers are experiencing double digit declines in advertising revenue, and the recovery to pre-COVID trends are expected to be incomplete or take many months to years. At Mather, we are helping our partners navigate scenario planning for print delivery day reductions through custom-built subscription and advertising forecasting tools. Below we will outline our approach and results from a recently completed study.

Objective

The purpose of this engagement was to assist a U.S. newspaper publisher with a strategic review of print delivery reduction scenarios by validating the publisher’s internal models using industry research and the building of custom forecasting tools. After models were built and validated, data-driven recommendations were provided to assist the publisher through a strategic shift in their business model from a 7-day print delivery model to a frequency model estimated to optimize operating profits after incorporating impacts to subscription revenue, advertising revenue, and expenses. Our approach included four major phases: a review of existing research and data of publishers that have previously reduced print service days, building a forecasting tool for print and digital subscription revenue, building a forecasting tool for print and digital advertising revenue, and overlaying expense projections with revenue forecasts to arrive at operating profit estimates.

Review of Existing Research

Benchmarks provide valuable data for the use in forecasting tools, and Mather’s database of hundreds of publishers including weekly subscriber data supplies ample data to inform these benchmarks. Of particular interest were markets in this database that had previously gone through the process of eliminating print service days. Mather reviewed this data to develop case studies and conducted interviews with various partners throughout the industry to help build out assumptions around the sensitivity of subscription and advertising revenues to changes in print delivery.

Subscription Revenue Forecast

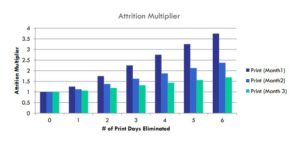

To assess the impact of print delivery day reductions on subscription revenue, Mather built a forecast tool that applied multipliers to the market’s existing revenue trend based on the benchmarks assembled during the research review. Multipliers were applied to starts and stops, with start multipliers decreasing linearly for each delivery day dropped, while stop multipliers were built on a glide path with an initial spike in attrition during the first month that diminishes slowly over the course of several weeks. Figure 1 below shows the glide path of attrition as a function of the number or print days eliminated.

Figure 1 – Attrition Multiplier for Subscription Revenue Forecast

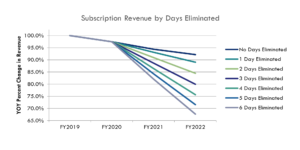

While print starts decline and stops increase with each delivery day dropped, our model assumed a transitory effect between print and digital subscribers as days were reduced. As fewer print days were available, a portion of print subscribers were expected to migrate to digital. Figure 2 below shows the estimated change in baseline (no print reduction) revenue as a product of reducing print service days.

Figure 2 – Subscription Revenue Forecast by Number of Days Eliminated

Advertising Revenue Forecast

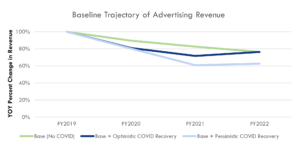

As mentioned, industry-wide advertising revenue has seen significant declines throughout the second quarter of 2020 due to the economic impact of COVID-19. In building out a model to forecast advertising revenue for future years, it was crucial to not only account for delivery day reductions, but also the lasting impact of COVID-19. To help inform our assumptions, we reviewed data on previous recessionary periods, namely the 2008 financial crisis, which gave valuable insight into the impacts of economic downturns on print and digital advertising in media. In particular, this research revealed that recoveries tend to be protracted and may never reach pre-recession trends. Mather started by forecasting a baseline revenue using 2019 actuals to show trends in the absence of COVID-19. From there, optimistic and pessimistic scenarios were built by estimating the speed of the post-COVID recovery. Once forecasting for the delivery day reductions, we modeled two different scenarios – one factoring in the optimistic post-COVID trends and one factoring in the pessimistic post-COVID trends.

Figure 3 – Baseline Trajectory of Advertising Revenue

Operating Profit Estimate

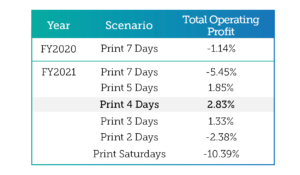

The final step in the process is to overlay the revenue estimates with the estimated expenses to arrive at a model of operating profit by number of days printed. The partner provided guidance on current expenses by line item, including editorial, production, newsprint and ink, circulation, advertising, and other areas. In addition, estimates for the reduction in these expense line items were provided by the number of days printed. For this particular publisher, current estimates pointed to a business as usual case of negative operating profit, which provided urgency to the print day reduction planning. After several thorough discussions with the publisher reviewing the assumptions, model iterations, and expense forecasts, we arrived at a consensus set of working models to estimate the final figures for decision making. Figure 4 below shows the estimated operating profit as a percentage of total revenue for each of the scenarios. Our forecasts indicate that profitability in the next fiscal year could be achieved by retaining three to five days of print delivery, while printing one, two, or seven days would result in negative operating profits.

Figure 4 – Estimated Operating Profit as a Percentage of Total Revenue by Number of Days Printed

Conclusion

As more publishers evaluate their business models and the prospect of print delivery reductions, a rigorous analytical framework becomes necessary for proper scenario planning and forecasting. At Mather, we have developed a robust set of tools custom built for projecting subscription and advertising revenue as a function of reducing print service days. We look forward to leveraging these tools to enable publishers to make informed and data-driven decisions during this period of transition in media.

DOWNLOAD PDF

For more information, contact Matthew@mathereconomics.com or Madelin@mathereconomics.com.