By Brandon Williams, Senior Manager, Matthew Lulay, Senior Director and Matt Lindsay, Ph. D., President

INMA Satisfying Audiences Blog – June 8, 2020

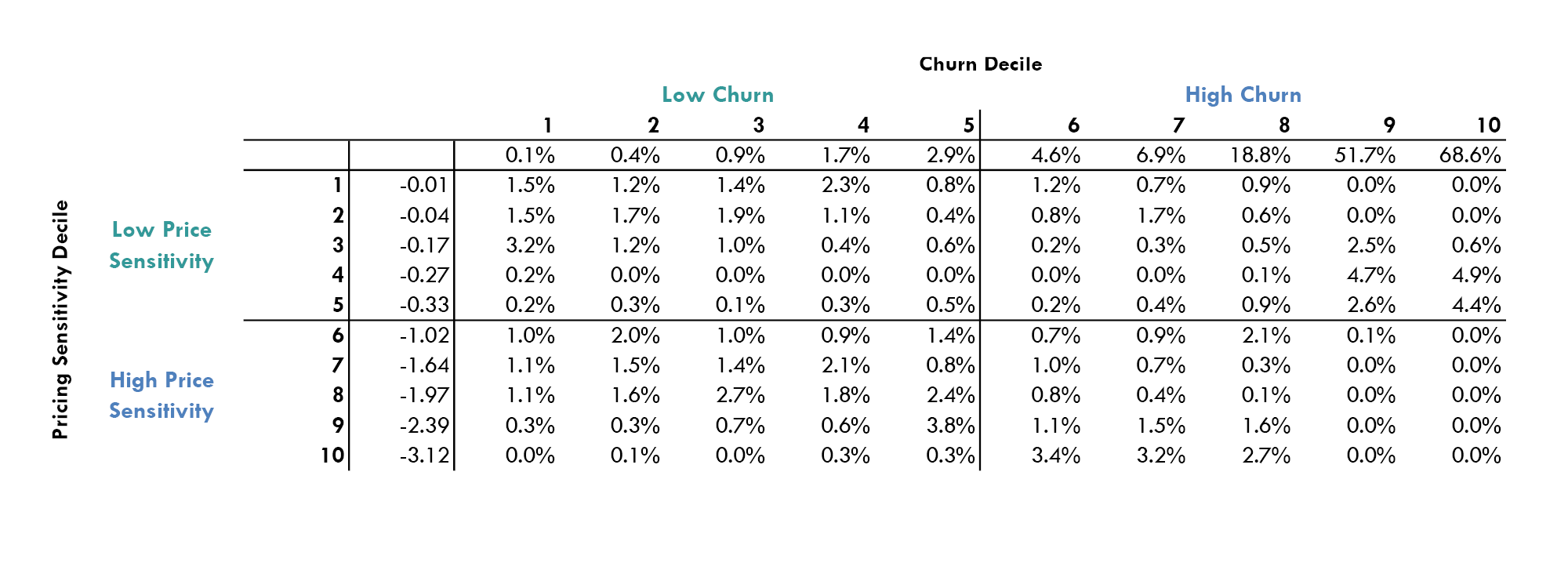

Two important characteristics to know about an individual subscriber are their risk of churning and their sensitivity to price. Estimating these two characteristics and categorizing subscribers into four quadrants defined by these two metrics can help determine the best course of action to take with each customer.

Mather Economics recently worked with an online publisher to develop these metrics for their digital subscribers. A sample of the output from our analysis is presented below.

Business tactics reflecting the nature of the customer’s relationship with the product can be developed for each quadrant in this chart. Below is a brief summary of the strategies and tactics recommended for customers in each group.

High churn risk and high price elasticity

Customers in this group will likely stop, but their decision can be swayed with a discounted renewal price offer. An effective tactic for these customers is to offer them a long-term renewal subscription with a guaranteed price per month.

Customers who fall into this category are often relatively new customers or customers with lower-than-average discretionary income. Long-term offers with a fixed monthly price give the customer time to become more engaged with the product and the predictability of a steady price point.

Low churn risk and low price elasticity

These customers are likely to remain subscribers and pay their renewal bills. The best course of action for subscribers in this group is to propose a premium service or additional product. They are often long-term customers with above-average household income.

High churn risk and low price elasticity

Subscribers in this segment are likely to stop, and price is not the reason for the churn. While a lower-priced retention offer may keep them, they are likely not engaged with the content or were sold the product using aggressive sales tactics or other purchase incentives.

These customers should receive messaging and retention campaigns that increase engagement and promote the product’s value proposition. A “value letter” from the publisher highlighting the benefits of their subscription is often effective. Also, a message describing the investigative journalism or unique content of the publication can increase retention of this group.

Low churn risk and high price elasticity

This category includes subscribers who are not likely to stop under the status quo, but they would be at-risk following a price increase. Individuals in this group are often long-term customers on a fixed income or have high awareness of subscription prices.

Interestingly, we find that everything else being equal, price elasticity and churn risk decrease as a customer’s engagement increases, but highly engaged digital subscribers often have higher-than-expected price elasticity. Our hypothesis is that these customers are very aware of acquisition offer pricing and notice when their renewal price is significantly more than the entry point.

Recommended tactics for these customers are lower-than-average renewal price increases or premium upgrades bundled with a price increase.

A “next best offer” (NBO) is a common tactic used in industries with subscribers besides the news media business, such as cable systems and mobile carriers. These NBO suggestions are not always sales offers but the next recommended conversation a company should have with a customer via any of the channels of communication.

They can include a message such as “Thank you for being a loyal subscriber” or “Are you aware your subscription includes access to our opt-in magazine?” Other recommended conversations can also be an inquiry into the customer’s recent service levels or a proposed conversion to autopay.

Predicted price elasticity and churn levels can be validated using A/B tests of price increases or retention campaigns. As in many other cases, the prediction of who is likely to churn and the measurement of relative price elasticity is often not as difficult as discovering effective tactics to affect customer behavior economically. An effective testing process is critical to identifying which tactics work best for certain customer types.

With both of these metrics, false positives can be costly. Low churn risk subscribers who receive high cost retention campaigns will dramatically increase costs, and low-price sensitive customers who receive discounts can significantly reduce revenue. Validating customers’ predicted behavior through testing will improve the accuracy of the estimated churn risk and price elasticity.

Utilizing insights on churn risk and price elasticity to match the best action to an individual subscriber, and validating the effectiveness of retention and pricing tactics through testing, will help maximize long-term customer value and profitability.