When thinking about the trends facing media publishing and magazine companies today, three challenges and opportunities emerge from the business issues our clients face in 2022.

Meet Bob Terzotis, executive vice president of Mather Economics and a 36-year career veteran in the newspaper industry.

Bob Terzotis, Executive Vice President, Mather Economics. will be at the World Media Congress in Cascais, Portugal, from 7-9 June. Below, he answers five quick-fire questions ahead of the conference. See the article here.

For more on Congress, to register and learn about networking opportunities with media, tech and other industry leaders, go to fippcongress.com.

TELL US ABOUT YOUR BUSINESS

Mather Economics is an economics consultancy based in Atlanta, Georgia, USA, and this year is our 20th anniversary in business. We work with more than 200 companies around the globe to provide world-class data science solutions for our business partners. In addition, Mather Economics is recognized as a pricing expert worldwide.

Our revenue-first strategy for media companies helps them harness the power of data to maximize multiple revenue streams and optimize how every piece of content drives engagement and revenue creation. Our analytic teams address the industry’s most critical issues, including mail expense reduction, renewal price optimization, churn reduction, and digital diagnostic services (including content economics, intelligent paywall solutions, and optimizing subscription & advertising revenues).

TELL US ABOUT YOUR ROLE IN THE BUSINESS

I am the Executive Vice President of Business Development for Mather Economics. I’ve been with Mather for ten years after a 26-year career in audience development for the newspaper industry.

WHAT DO YOU SEE AS THE THREE MAIN CHALLENGES FOR MEDIA?

The biggest challenges our magazine clients are addressing include reducing mail costs, more effective pricing strategies, and digital transformation.

- The most pressing magazine industry challenge is rising postage, printing, and delivery costs. Mather provides analytic solutions that apply targeted reductions of renewal efforts, achieving savings while maintaining response rates.

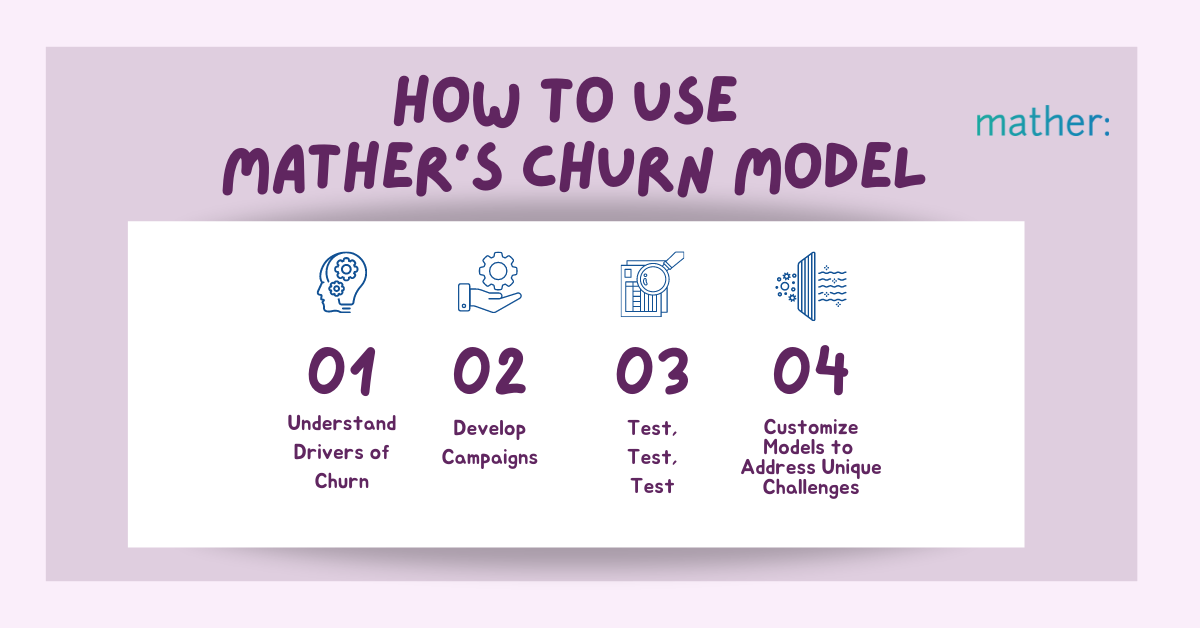

- Churn reduction while optimizing price is critical to client success. Our market-based pricing service provides a tactical method for identifying a subscriber’s price sensitivity, leading to more robust pricing recommendations. Our models show significant revenue yield improvements and mitigate churn, improving a publisher’s P/L.

- Digital disruption is a significant challenge; publishers need to develop and implement their digital transformation roadmap by identifying compelling content that drives engagement, conversions, and revenue. Further, consumer marketers must determine the best paywall strategy for their content model and align their organization around specific KPIs. Mather has worked with media companies for 8-10 years, helping them navigate these changes through strategic advisory services, including industry benchmarks and best practices.

WHAT DO YOU SEE AS THE THREE MAIN OPPORTUNITIES FOR MEDIA?

Content creation is still the essential aspect of the media, and identifying what content compels audiences to action is the most crucial activity in media. Publishers should embrace rich data sources to identify that content or offer influences the customer journey. Further, shared experiences help publishers; Mather has been providing industry benchmarking and best practices for the newspaper industry for twenty years and is looking forward to sharing those approaches with magazine publishers.

As part of the digital transformation, the opportunity to test strategies and then rapidly adjust has never been more important, so we recommend constant testing and failing fast.

WHY SHOULD PEOPLE MEET WITH YOU AT THE CONGRESS?

I hope to chat with as many people as possible at Congress and stay connected in the future. Mather Economics has a team of 50+ economists and data scientists who love to help clients creatively solve their challenges. Our work with a client is custom to their needs, and we support both data transformation work, including modeling, or supporting the team with strategic consulting as needed. Finally, we work with a diverse group of media clients and have many use cases and best practices to share, so look me up when we are in Portugal and tell Mather how we can help you! Connect with Bob Terzotis at bob@mathereconomics.com or get time on his calendar at https://bit.ly/3x1db9x