SUMMARY: Current macroeconomic conditions have publishers and consumers alike considering how to navigate this new economic climate. Companies across all industries are trying to determine the right balance between raising prices in the face of higher production costs while maintaining demand and profitability.

Featured on INMA | 07 November 2022

By Nathan Hart, MS, and Luke Boutwell, Ph.D.

GET THE REPORT

Current macroeconomic conditions have publishers and consumers alike considering how to navigate this new economic climate.

Companies across all industries are trying to determine the right balance between raising prices in the face of higher production costs while maintaining demand and profitability.

Key Insights

- As inflation rises, overall subscription cancellations rise as consumers’ income decreases.

- Price-related stops decline for both print and digital subscribers during inflationary periods.

- Contrary to anecdotal evidence, a subscription price increase may be more acceptable to consumers when prices rise for other goods.

- Consumers seeking to reduce spending may cancel subscriptions regardless of price.

- A dynamic pricing model to optimize pricing for customer segments based on their price and income elasticities will help you reach your audience and revenue goals.

Mather’s analysis of pricing during an inflationary period uses data on print and digital subscribers from more than 200 news media publications whose subscribers had renewal price changes from 2020 to 2022.

Statistical analysis of print and digital subscriber behavior yields insights into how print and digital news media subscribers react to price changes and inflation. These insights can guide publishers’ strategic subscription pricing decisions as part of their reader revenue strategy.

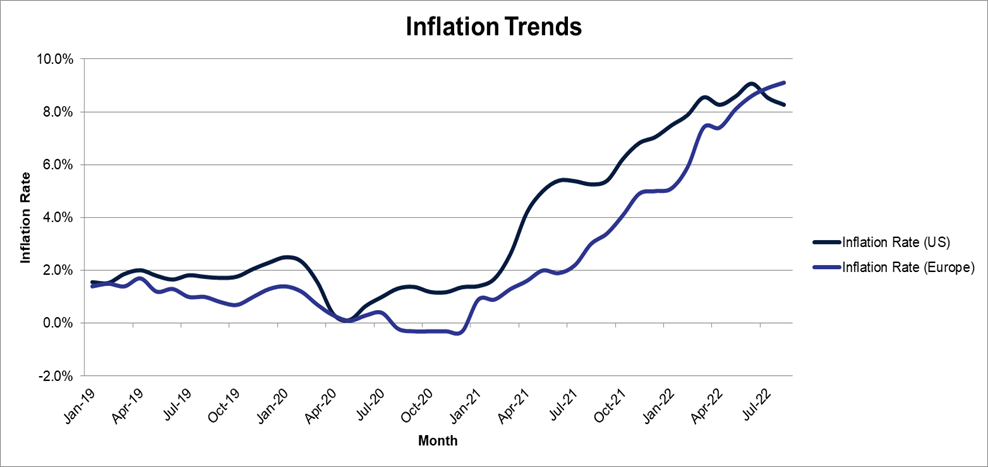

The chart below shows year-over-year inflation for the United States and European Union.

Source: US inflation rate: bls.gov; EU inflation rate: Eurostat

Isolating organic churn vs. price-related churn

Periods of high inflation and rising production costs are difficult for business management due to the uncertainties about achieving the revenue growth needed to offset cost increases. Publishers feel pressure to increase revenue but are concerned about subscribers’ willingness to pay.

Our research uses data on digital and all-access subscribers from over two hundred publications. The analysis reveals that higher inflation does not negatively affect subscribers’ response to price increases. When implementing a pricing strategy, it is essential to understand this dynamic and separate organic churn from price-related churn.

Organic churn (attrition) measures overall subscriber cancellations regardless of price changes. Our findings show that overall churn rises during periods of high inflation.

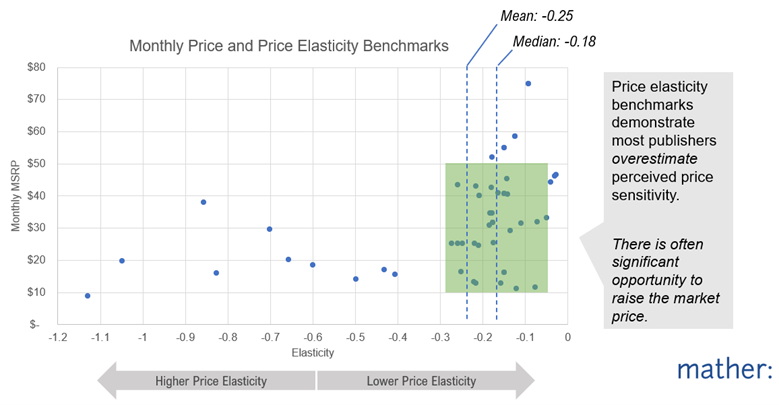

By isolating incremental price-related churn, we can measure the price elasticity (price sensitivity) of print and digital subscribers’ changes during periods of high inflation. Our research shows that price elasticity declines during periods of high inflation. Over a decade of managing pricing for hundreds of titles shows that that publishers overestimate renewal price elasticity.

The chart below shows that the average elasticity for a sample of publishers is -0.25.

Watch Matt Lindsay, president of Mather Economics, explain price elasticity and how they help publishers find their ‘sweet spot’ with pricing.

These data were collected through ongoing A/B testing using Mather’s Market-Based Pricing Service vs. a no-price control group, which isolates the price increase against a representative sample of subscribers. Measuring the difference in performance between the test and control groups isolates the true impact of consumer response to a targeted price increase.

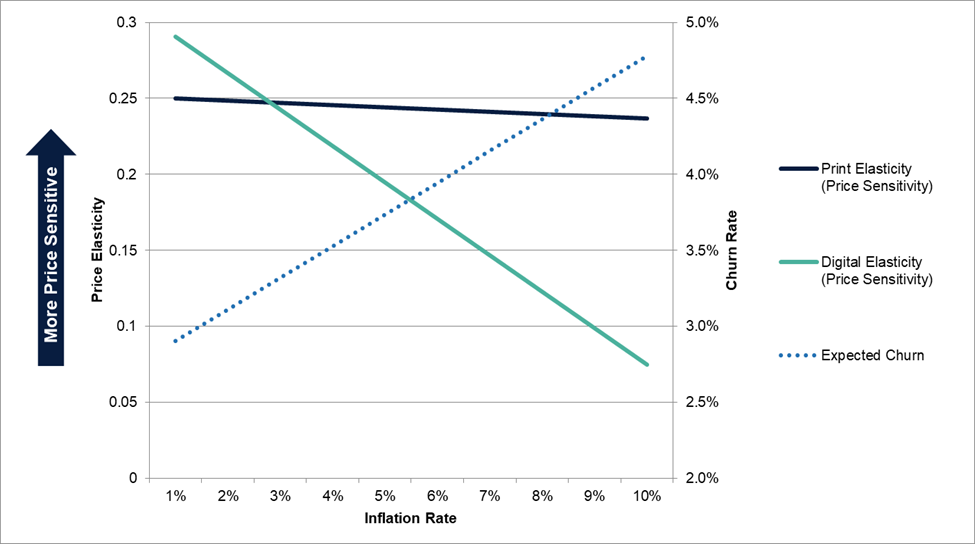

The graph below shows the relationship between print subscribers and digital-only subscriber price elasticity, organic churn, and inflation.

It is not surprising that organic churn rises during inflationary periods. Consumers are forced to make tough decisions about where to allocate their discretionary income, and these decisions may cause higher churn from younger and digital-only subscribers as they rationalize their spending.

Contributing to churn is the trend of using subscription management and budgeting apps that tout savings from cutting subscriptions. During inflationary periods, (somewhat counter-intuitively) price elasticity is reduced as local news subscriptions are a relatively price-inelastic good.

There are few alternatives for quality local journalism; in the United States, there is typically one local news publisher for a community. This contrasts with easily substitutable goods, such as soft drinks or streaming services (multiple brands and services provide comparable goods).

Thus, when developing a pricing strategy, publishers should consider their value proposition and competitors carefully.

Now that we understand the dynamics of organic churn vs. price-related churn, what should publishers do?

Four tips for managing subscription churn and pricing during inflation

1. Preempt churn.

Churn models can predict which subscribers are at risk of canceling their subscriptions. Publishers can intervene with targeted communication via e-mail, testing incentives via direct mail, or other channels to mitigate churn. Some elevated churn may be inevitable during inflationary periods, but proactive outreach to high-risk and high-value subscribers can reduce the loss of your valuable subscribers.

2. Engage readers.

Research finds that digital engagement is a crucial driver of the propensity to subscribe, and engagement significantly improves retention and lifetime value. Digital-only subscribers can be re-engaged via targeted newsletter signups, opting in for desktop notifications, downloading a news app, and personalizing content curation via e-mail or the home page.

Print readers can be engaged via e-edition as a retention tactic to mitigate price reductions. Mather’s benchmarks indicate that digital subscriptions will overtake print subscriptions in the next 14 months. The e-edition can serve as a bridge for print subscribers to engage digitally and, more importantly, avoid cutting their price by one-third.

3. Price intelligently.

A dynamic pricing model mitigates churn while maximizing yield. The risk of losing a high-value print subscriber is much greater in 2022 than it was in 2012 as prices have increased and as the economics of print have evolved.

Targeted pricing should be a vital part of each publisher’s pricing and revenue management strategy for print and digital-only subscribers. Publishers feel pressured to cut print delivery days due to reduced advertising spending and as inflation raises printing and delivery costs. Mail delivery poses new challenges and pricing rules that should be tested in the market.

Without a doubt, digital engagement is a significant driver of the pricing decision, along with subscription tenure, term length, demographics, and many other factors.

4. Demonstrate your value proposition.

It is important to differentiate the value and impact of quality local journalism via marketing, good user experience, relevant content, and outreach to subscribers. Loyal subscribers who are invested not just financially in their local newspaper will be more likely to accept a price increase. Explaining the challenges of rising delivery and production and what it takes to produce quality journalism will put any price changes in context.

All subscribers have a price they are willing to pay in exchange for a quality product and understanding that individual price sensitivity allows a more nuanced approach to managing subscriber revenue

See how we’ve helped ambitious clients achieve extraordinary outcomes.

Connect with a team member to learn how Mather Economics can mitigate churn and develop a robust pricing strategy during inflationary periods.

About the Authors

GET THE REPORT

Take me to pricing case studies.

Research: consumer spending on subscriptions are likely to remain steady