By: Matt Lindsay, CEO, Mather

In an interview at the 2025 INMA European News Media Conference, Peter Vandermeersch, CEO of Mediahuis Ireland, emphasized that the news industry must evolve faster and more fundamentally than ever before to ensure its survival. I share Peter's urgency and support his conclusion about the need for rapid change. In this post, I’ll apply that advice to one critical area of the digital business model—content pricing. I use the term “content pricing” rather than “subscriptions” because publishers must consider all types of consumer transactions that generate profitable consumer revenue.

Innovation and experimentation are urgently needed. In today’s hyper-competitive market, publishers must seize every opportunity to create and capture value. Investments in differentiated content, compelling bundles, and effective marketing build that value, but monetizing it requires sophisticated pricing strategies. At Mather, we call this “intelligent pricing,” though it is often referred to as “dynamic pricing” or “yield management.”

The Cost of One-Size-Fits-All Pricing

Despite the need for business model innovation, many publishers continue to implement one-size-fits-all pricing strategies that are counter to their strategic objectives. These pricing models are easier to develop and implement, making them a compelling choice for marketers and data privacy teams. There are cases where simple pricing is desirable, usually when setting acquisition offer prices. However, over the lifecycle of a customer relationship, optimizing pricing for a customer segment yields dramatic improvements in average rates and customer retention.

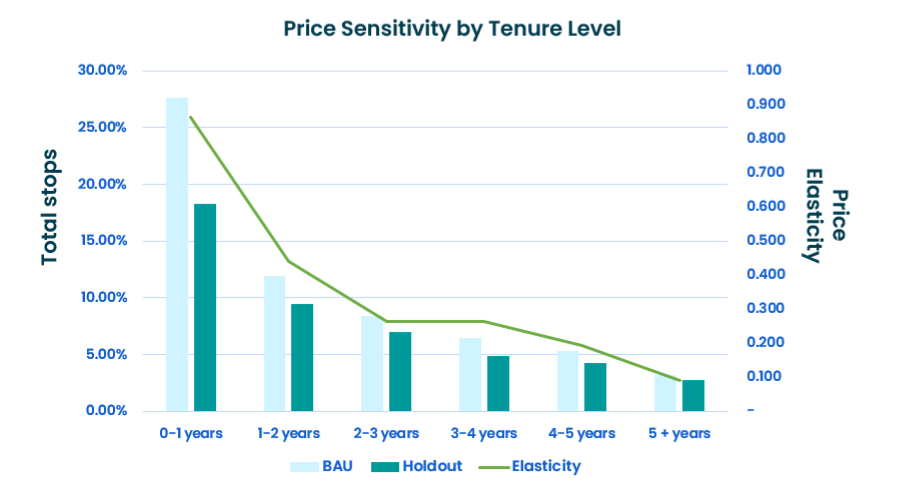

The opportunity cost of simplistic pricing strategies, measured in lost revenue and increased customer churn, is substantial, often tens of millions of dollars per year. Much of that stems from a limited understanding of price elasticity, or how sensitive customers are to price changes and how that sensitivity varies across different segments. When publishers overlook elasticity, they risk applying blanket increases that push away their most price-sensitive customers while undercharging those who are willing to pay more.

When the alternative is cutting costs, often through widespread job reductions, sophisticated pricing actions appear more attractive and worth the investment. Our experience shows just how powerful this shift can be in practice.

What Publishers Are Seeing in Practice

Mather has worked with thousands of publishers over the past two decades to design and implement pricing strategies that maximize long-term consumer revenue. In recent years, demand for support with digital pricing has grown sharply, and the results have been significant. A few examples:

- Intelligent pricing outperformed static step-up prices with lower incremental churn (2.5% vs 5.7%), greater retention of pricing revenue (80% vs 62%), and higher revenue growth per customer despite lower average price increases.

- For a large regional publisher with hundreds of thousands of digital subscribers, intelligent renewal pricing delivered 24% higher ARPU, 16% growth in top-line revenue, and less than 1% incremental stops compared to across-the-board annual increases.

- Another leading U.S. news publisher with both regional and local titles implemented intelligent pricing company-wide, resulting in 8% more digital subscription revenue and only 0.4% incremental churn compared to standard tiered pricing.

These results highlight how intelligent pricing strengthens top line revenue and retention. Equally important for publishers are the implications for profit margins and for how readers experience these strategies.

High Return on Investment

Revenue gains from strategic pricing flow directly to the bottom line. According to INMA, in 2023, the median operating profit margin for news media companies was 6%. A 1% increase in top-line revenue, achieved with minimal added costs, translates into a 16.7% increase in profit margins. Intelligent pricing often yields a 6-8% lift in consumer revenue.

The airline industry offers a useful comparison. With profit margins in the low single digits, airlines use dynamic seat pricing to grow revenue by five to six percent, which delivers a substantial boost to operating profit. Still, a strong ROI is only part of the story. Publishers want to know whether intelligent pricing is fair, and whether it’s realistic to implement.

Fairness and Intelligent Pricing

Most people who feel differentiated pricing is not fair frame their answer around raising prices for the least price-sensitive customers. In reality, the primary reason these strategies are effective is that they reduce churn among the most price-sensitive customers, often the youngest or lowest-income tier of their audience.

The 80/20 rule applies perfectly: 80% of pricing-related churn comes from 20% of digital customers. Identifying those 20% and giving them a smaller price increase (or none at all) is where most of the return on investment in intelligent pricing comes from. Indeed, customers with a higher ability and desire to pay will receive larger increases than the average, as they are getting more value from your products and are willing to pay for that value.

Economists have found that intelligent pricing results in a Pareto improvement in numerous industries, meaning all parties are better off, with firms realizing increased profits and customers experiencing greater consumer welfare.

And importantly, intelligent pricing does not require sensitive consumer data. Most of the variables used in price sensitivity models are publicly available or do not depend on customer-specific information.

Complexity and Implementation

Digital products have far fewer options than print. Everyone receives the product daily, and nearly all customers are on a monthly or annual subscription. There is no need for multiple price points tied to billing terms, delivery frequency, or payment methods.

Additionally, most new subscription management platforms now support intelligent pricing out of the box, and AI tools can automate many of the tasks involved in implementation.

On that foundation, Mather brings the intelligence and expertise that help publishers strike the right balance between incremental revenue and complexity.

Key Elements of Intelligent Pricing

Intelligent pricing uses estimates of price elasticity, combined with business rules and statistically valid testing, to maximize long-term consumer revenue. Business rules can be fixed and rule-based (deterministic), such as “don’t increase prices for customers who received an adjustment in the last six months.” They can also be model-driven (probabilistic), for example, “if a customer is predicted to have a high likelihood of canceling, then minimize or skip their price increase.” In these cases, decisions rely on probabilities like price elasticity or customer propensity.

Accurate measures of price sensitivity, paired with clear methods for applying those insights to pricing decisions, are essential for success. Regular A/B testing and performance reporting ensure the strategy remains accurate and continues to deliver results.

In Conclusion

As publishers face existential threats from new technologies and competitors, static, across-the-board pricing is no longer enough. Intelligent pricing provides a means to increase revenue and decrease churn among digital customers, while enhancing long-term profitability.

At Mather, we know publishers face difficult choices to survive. Intelligent pricing can provide added revenue and flexibility to adapt, invest, and sustain the quality journalism that readers and communities rely on.

Email Matt | Follow Mather on LinkedIn