By: Arvid Tchivzhel

TLDR

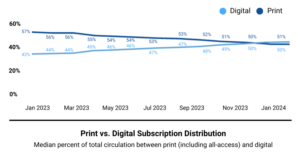

• In late 2023, digital subscribers surpassed print subscribers in the US news media industry, signaling a pivotal moment for publishing leaders.

• Despite digital growth, revenue from digital subscriptions remains low, accounting for less than 1/3 of print revenue.

•To sustain newsroom funding, media companies must continue to invest in digital products and diversify revenue streams.

Key investment areas include growing new audiences, leveraging AI, optimizing content, and improving user experience.

• Intelligent pricing and yield management of the print business can help fund digital initiatives as demonstrated by Mather Economics’ Market Based Pricing (MBP) solution.

• CASE STUDY: Over a three-year period, a publisher using MBP grew topline revenue by 3%, even as total volume declined by 12%. This approach enabled them to focus resources on their content strategy and the digital reader experience.

• Leveraging legacy print business to fund digital maturity initiatives is a crucial strategy for media leaders in 2024 and beyond.

The Current State

The US news media industry reached a significant milestone at the close of 2023. According to Mather Economics’ latest quarterly benchmarking report, digital subscriber volume has surpassed print subscriptions, signifying a pivotal moment for industry leaders. The rapid decline in print circulation shows no signs of slowing. Digital revenue remains at less than one-third of print subscription revenue, intensifying the pressure on publishers to devise innovative strategies for fostering digital growth.

The Opportunity

Many publishers have made strides in their digital transformation over the last decade, increasing their focus on consumer revenue, investing in technology and data science, expanding newsletters and content verticals, and more.

Although digital subscriptions are expected to remain a core component in future revenue streams, relying solely on subscription growth may not fully compensate for the decline in print revenue.

Forward-thinking media enterprises must continue to invest in their digital subscription strategy, diversify their product offerings, and identify new monetization channelsto secure long-term sustainability.

Key areas for investment include:

With many potential avenues for growth, developing and aligning teams around a roadmap requires careful consideration. Some investments may yield immediate accessibility and return on investment (ROI), while others demand long-term dedication and continuous evolution.

One Proven Approach

No roadmap is complete without a plan for funding new initiatives, and Mather’s Market Based Pricing (MBP) solution can be the key to unlocking these opportunities. MBP is a data-driven pricing intelligenceprogram that has generated billions in incremental revenue for publishers since its inception in 2002.

MBP works by leveraging historical transaction data, information about the subscriber, and engagement with the publisher’s products to determine the best price that maximizes revenue while minimizing price stops.

Before the introduction of Mather’s MBP solution, publishers typically assigned a uniform price to each subscriber, applying a one-size-fits-all approach. This outdated pricing method often resulted in missed revenue opportunities. Mather’s research over two decades has unveiled common patterns prevalent throughout the industry.

- Certain print subscribers, often younger and less affluent, are highly price sensitive and may churn if prices increase significantly, hindering publishers from nurturing long-term subscriber relationships.

- Conversely, older, more affluent subscribers, who are engaged with digital products, can absorb price changes with minimal impact on churn, resulting in higher yield from pricing increases.

- Understanding the diverse sensitivity to pricing among subscribers enables publishers to optimize their decisioning to grow revenue while retaining subscribers.

The revenue generated from MBP enables publishers to fund digital initiatives by extending the life of high-LTV print subscriptions, “buy time” for organizational realignment, and grow ARPU.

A Case Study

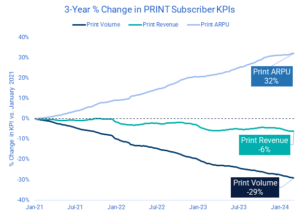

In the charts below, we take an anonymized example from one of Mather Economics’ long-term newspaper clients actively using MBP for print/hybrid and digital-onlysubscriptions.

Our key metrics include volume (active subscribers), revenue, and average revenue per user (ARPU – the price of the subscription). Mather tracked the percentage change among these top-line metrics from January 2021 to January 2024.

Optimizing Print to Extend the Runway for Digital Growth

The chart below shows a significant decline in print subscriber volume (29%) over a three-year period. However, with the implementation of Mather’s intelligent pricing algorithm, MBP, print subscriber revenue only declined by 6% over the same period.

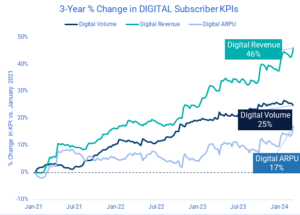

Maturing Digital Strategy while Growing ARPU

With Mather maintaining print subscription revenue, the publisher was able to focus their team on digital initiatives, achieving substantial growth over a 3-year period. As shown in the chart below, digital revenue grew nearly 50% on top of a 25% growth in digital subscriber volume.

Some key investments made by the publisher during this time included:

- Technology (improving site speed, better SEO, and a less porous paywall)

- Better UX (well-built homepage, 2-step checkout process, integrating flexible payment methods)

- Reinforcing local content by the newsroom

The publisher also applied MBP to digital-only subscribers, successfully growing ARPU and digital revenue.

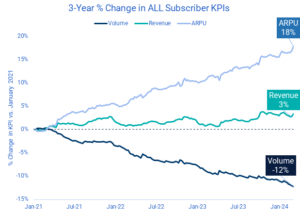

Impact of MBP to Topline Revenue and Volume

Combined, print and digital subscriptions grew topline consumer revenue by 3%over a 3-year period, even as total volume declined 12%.

This publisher has not yet reached the “print to digital crossover point.” So far, digital subscribers only account for 44% of total subscribers and 26% of total subscriber revenue. However, they are poised for continued digital growth and can continue funding these growth investments by extending their legacy print business.

Setting Your Strategy for 2024

Establishing clear and executable strategies is a must for media leaders. One component in this strategy is leveraging the legacy business to fund new, growing parts of your business.

In this article, we shared a case study of how a publisher used Mather’s Market Based Pricing solutionto maintain print revenue while growing digital revenue.

We also shared a list of opportunities and ideas to invest in future growth. Publishers have an opportunity to establish a strong foundation and growth trajectory for the future media business model – let print revenue pay for your future.

Reach out to our media experts to learn how MBP can fund your future growth!