August 2021 | 4 min read

SUMMARY: The growth in digital subscriptions is encouraging, however the revenue contribution from print subscriptions far outweighs that of digital subscriptions. Here is what recent research shows.

Publishers that deliver news through both print-only (or all-access) and digital-only products are facing the challenge of managing the transition toward a digitally dominant subscription economy.

Mather’s benchmarking database shows that print volumes in the United States declined by ~16% during the past year, while digital volumes grew by ~18%. Given these trends, the average news publisher will have a majority digital-only subscriber base by the middle of this decade.

While the growth in digital subscriptions is encouraging, the reality facing publishers today is that the revenue contribution from print subscriptions far outweighs that of digital subscriptions.

In fact, while digital subscribers make up 23% of overall subscriber volumes for the average publisher, only 11% of total revenue comes from this group.

We find that, on average, the ARPU of a digital subscriber is only 1/3 that of a print subscriber. Thus, the long-term sustainability of news publishers relies on the ability to intelligently manage the transition to a digital future.

In this blog post, we will briefly investigate the makeup of print to digital conversions, including how E-edition engagement is proving to be a leading indicator. We will also discuss some strategies for publishers to consider to preserve revenue on converted subscribers.

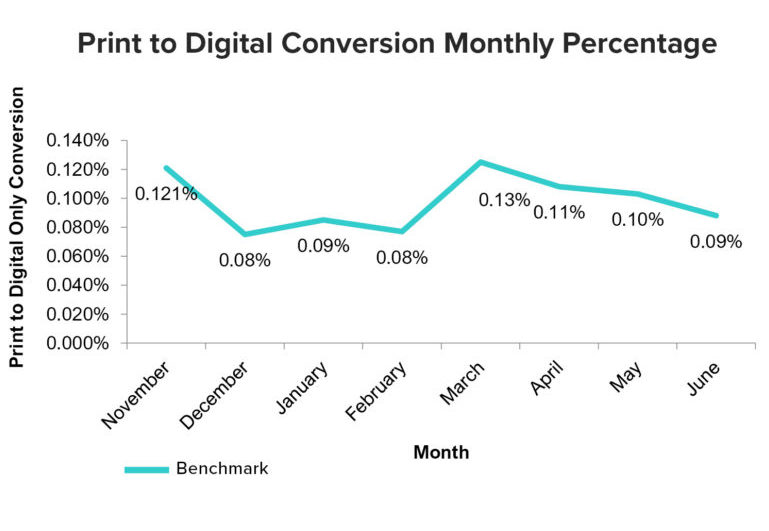

In an analysis with one of our publishing partners, we found that over the previous year, about 0.1% of the print subscriber base was converting to the digital only product every month. This metric was in line with the average monthly conversion percentage within our benchmarking database, as shown in Figure 1. This implies that just over one percent of a publisher’s print subscriber base is converting to digital-only every year, on average.

Figure 1

Benchmark Monthly Print to Digital Conversion Percentage

The same analysis revealed the average rate of accounts that converted to digital went from a print rate of $8.46 per week to a digital only rate of $1.41, resulting in an 83% cannibalization of ARPU.

This indicated many of the conversions started on the digital product at a highly discounted introductory rate despite being tenured accounts, with a majority (58%) having five or more years of tenure with the market at the time of the conversion. Additionally, a plurality (48%) of the print to digital conversions migrated from a full, seven-day print schedule.

Beyond price, tenure, and frequency, print to digital conversions also exhibited interesting digital engagement attributes. We found, generally, that conversions were deeply engaged with digital content, exhibiting the highest levels of article page views and lowest levels of non-engagement in the last thirty days of any subscriber cohort analyzed, including print-only, digital-only, and digital to print conversions.

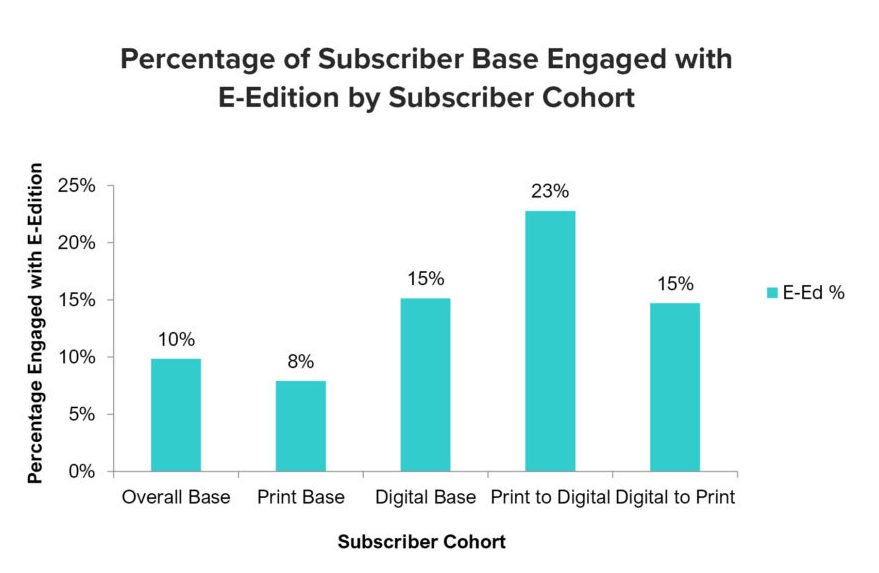

Of particular interest is how print to digital conversions engaged with the E-Edition in the period leading up to the conversion. As seen in Figure 2, conversions had the highest percentage of subscribers engaging with the E-Edition of any cohort analyzed at 23%, seven percentage points higher than the digital-only subscriber base at 15%.

Additionally, conversions had 2.5x the number of page views on the tablet than digital-only subscribers and 45% more unique days engaged with the E-Edition in the previous 30-days.

Figure 2

Percentage of Subscriber Base Engaged with E-Edition

As we have seen, print to digital conversions have a unique makeup of attributes and engagement behaviors. In particular, our research indicates the hypothesis that print users view the E-Edition as a bridge or gateway to adopting the digital-only product is correct.

Publishers can mitigate the rate cannibalization from conversions by proactively offering digital packages to print users highly engaged with the E-Edition that are higher than the introductory digital price. These offers can be prioritized to print users that have low or negative profitability given their current rate and cost to serve.

Publishers can also implement application fees to dissuade customers from “promo jumping,” where subscribers routinely sign up for introductory rates and stop when the promotion period is over only to restart on a new promotion weeks or months later.

Contact the experienced team at Mather Economics for more case studies and strategies to help guide the next steps in your digital subscription journey.