Written by Luke Boutwell, Ph.D., Ian Fitton, Matthew Lulay, and Matt Lindsay, Ph.D.

January 2, 2022 | 3-min read

Hundreds of publishers across the world have helped sustain their businesses and fund their journalistic mission through revenue generation using Mather Economics’ Market-Based Pricing (MBP), where pricing strategies are informed by predictive analytics to better fit rates to an individual’s willingness and ability to pay. The vast majority of our publishing partners have been with us for an extended period of time, with many working with us on pricing strategy for a decade or more. While these long-term pricing strategies have produced significant revenue streams, they have also increased pricing on core customers to historically high levels.

The result is these subscribers have very high lifetime value, and as such, also present disproportionally high risk from a subscription stop or a downgrade in rate. At Mather, we have been researching risk-mitigation strategies to make pricing strategies more effective in markets with long-running programs.

How does pricing strategy affect your business?

A major component of that research focuses on the impact of previous responses to price changes. Mather’s core MBP algorithm minimizes cancelations, the primary revenue risk for most markets, from a pricing action by distributing the increase across subscribers according to their characteristics and past behavior. This approach has successfully generated robust revenue streams with returns on investment regularly exceeding 10:1 while maintaining relatively high circulation levels. Over time, subscribers that have received multiple price increases may be prompted to call customer service and move to a lower rate, and this tendency can present a significant revenue risk. A tenured, high-rate subscriber who responds to a price increase notification by calling customer service to obtain a lower rate may cost the publisher more than the cancelation of a lower-rate subscriber.

"In the end the numbers always hold the weight of truth and that is what Mather was able to do for us. They helped us use our data in a way we had not been, in order to pinpoint our most viable options." Vice President, Chief Revenue Officer

U.S. Newspaper Publisher

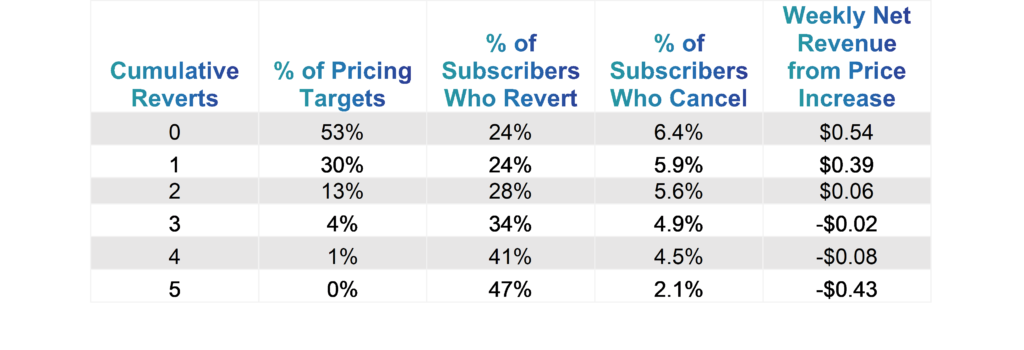

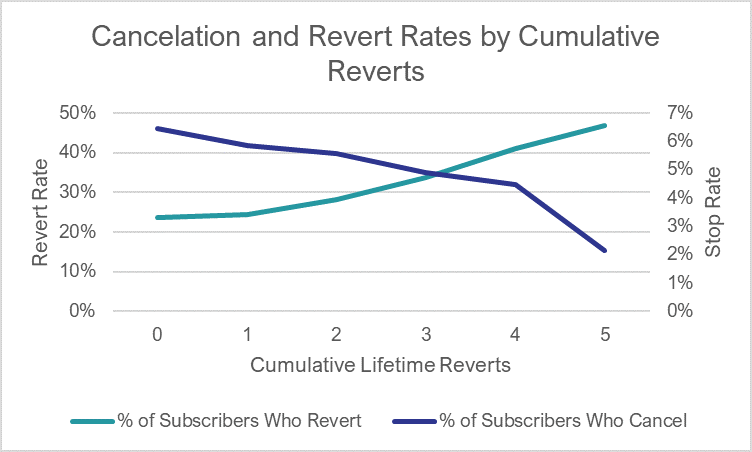

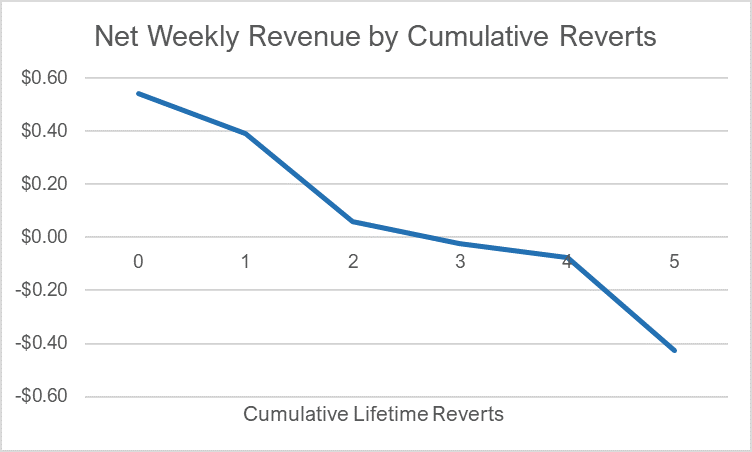

Subscribers who have received multiple price increases are more likely to call customer service regarding their subscription. A concern is that subscribers can become conditioned to complain about an increase because they know that publishers will offer a discount to avoid a cancelation. Below is a table that demonstrates the outcome of a price increase for a representative (based on geography and market size) sample of 31 markets that receive tens of millions of dollars annually from subscription price increases. The table shows that, as the number of reverts accumulates over a subscriber’s lifetime, the net revenue received from a pricing action decreases. The table also shows that the proportion of subscribers who revert and cancel increase and decrease, respectively, as subscribers become accustomed to customer service retention practices. These phenomena are illustrated in the graphs below.

Figure 1 | Reverts over Subscriber’s Lifetime

Figure 2 | Cancelation and Revert Rates by Cumulative Reverts

Figure 3 | Net Weekly Revenue by Cumulative Reverts

It is notable that the subscribers who have been given multiple price increases and reverted retain much better than those who have not. These subscribers are often highly-tenured subscribers with a high demand for the product, and in many cases are paying some of the highest rates in the market.

What tactics can be used to mitigate the revenue risk from the core customers?

A simple tactic that reduces the risk of customer service calls and price reductions is to simply exclude these customers from the pool of subscribers who are eligible for a price increase – either perpetually or for a period of time. This simple business rule can have a significant effect on subscriber revenue and retention. In the example from the table above, if each publisher excluded subscribers with more than two lifetime reverts, the number of subscribers that receive price increases would decrease by 5%, revenue per subscriber would increase by over 6%, and stops would decrease by 4%. The customers that are excluded from the pricing changes will retain their current rate, which is typically higher than the market average, and be spared the price change notification which can improve customer experience. This strategy can also reduce the burden on the customer service department by avoiding predictable customer interactions regarding price changes.

While this approach is relatively simple, it requires that publishers have information on subscriber responses to prices increases over an extended history, and that is information that publishers often do not have readily available. At Mather, we collect this data over time so that we can offer our clients insights on their long-term customers and implement tactics based on those insights.

The pricing tactics discussed here are among many other pricing strategies that can be employed at your company to grow revenue and customer volumes.