By Matt Lindsay, President of Mather Economics

December 2021 | 5 min read

We share insights in this blog post about how brand marketing and acquisition campaigns work together to affect subscription revenue. These findings are from a recent Media Mix Modeling (MMM) engagement we completed with a large news brand in the United States and from recent work on subscription analytics with many other news brands.

For the MMM engagement, we utilized econometric models to measure how digital subscription sales per week changed in response to marketing activities across different channels. Marketing spend was either building brand awareness or targeting subscriber acquisition. The results from the econometric models were then applied in a financial model to calculate the ROI from alternative marketing spend by channel.

Some channels have limited capacity. Organic search is one example where there is only so much volume of organic search results to utilize. Once a channel’s capacity is exhausted, the firm must choose among the next best channels that are still available. This type of channel optimization leads to varying marketing effectiveness as spend increases across both branding and acquisition marketing.

Our findings from the Media Mix Modeling (MMM) analysis:

- Total marketing activity accounts for roughly 65% of digital subscription sales at that publisher.

- Brand and acquisition marketing are both positively and statistically significant drivers of unique subscription sales prospects.

- Brand marketing is about 3X as effective in generating unique prospects as acquisition campaigns on a marginal cost basis at the current spend level

- There are diminishing returns on spend for both types of marketing.

- The diminishing returns is stronger with brand marketing, meaning that the incremental lift from additional brand spend declined faster than acquisition spend.

- Brand marketing is found to have a stronger impact on total visitors across the entire sales prospect spectrum (high propensity to low) compared to acquisition spend.

- As expected, acquisition campaigns are most effective on high propensity targets but become less effective when moving to medium and low propensity targets.

- Brand marketing was positive and significant for growing all types of visitors.

- Brand marketing is more effective at generating top of funnel traffic with a minimal statistical relationship between brand spend and immediate order volume was observed

- Acquisition campaigns are less effective than brand spend in generating site traffic, but they have a positive and statistically significant effect on digital order volume.

- Brand marketing has a longer effect on customer activity while acquisition campaigns have a shorter effective lifespan.

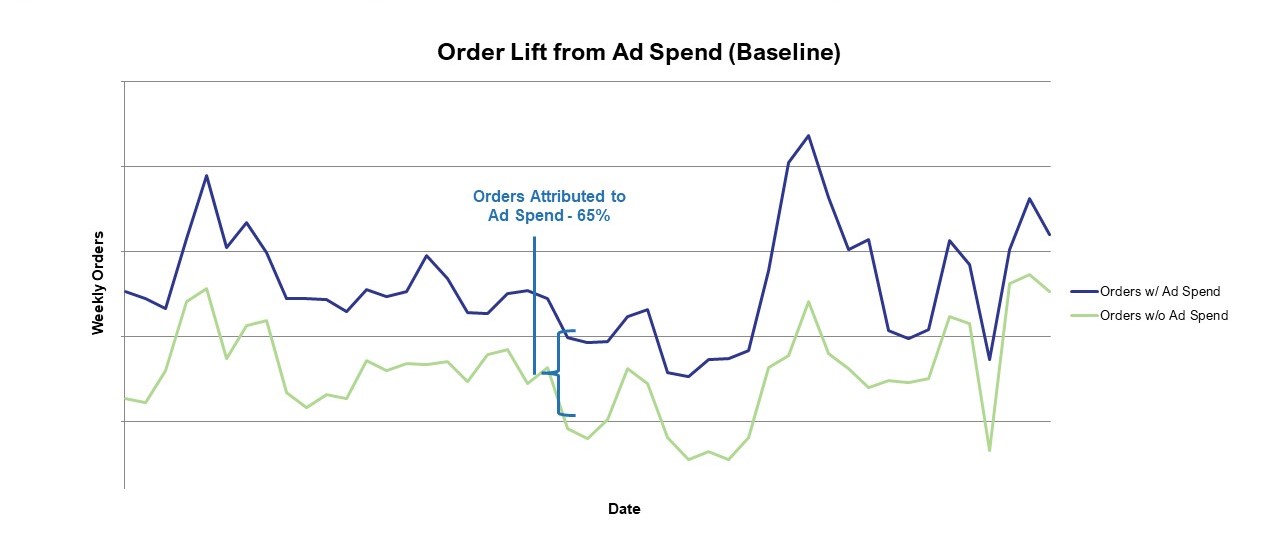

For the publisher we worked with, marketing was responsible for 65% of their digital subscription sales across both brand and acquisition campaigns. A graph illustrates the sales by week for a calendar year under their actual marketing and a projected level without marketing.

Figure 1: Order Lift from Ad Spend (Baseline)

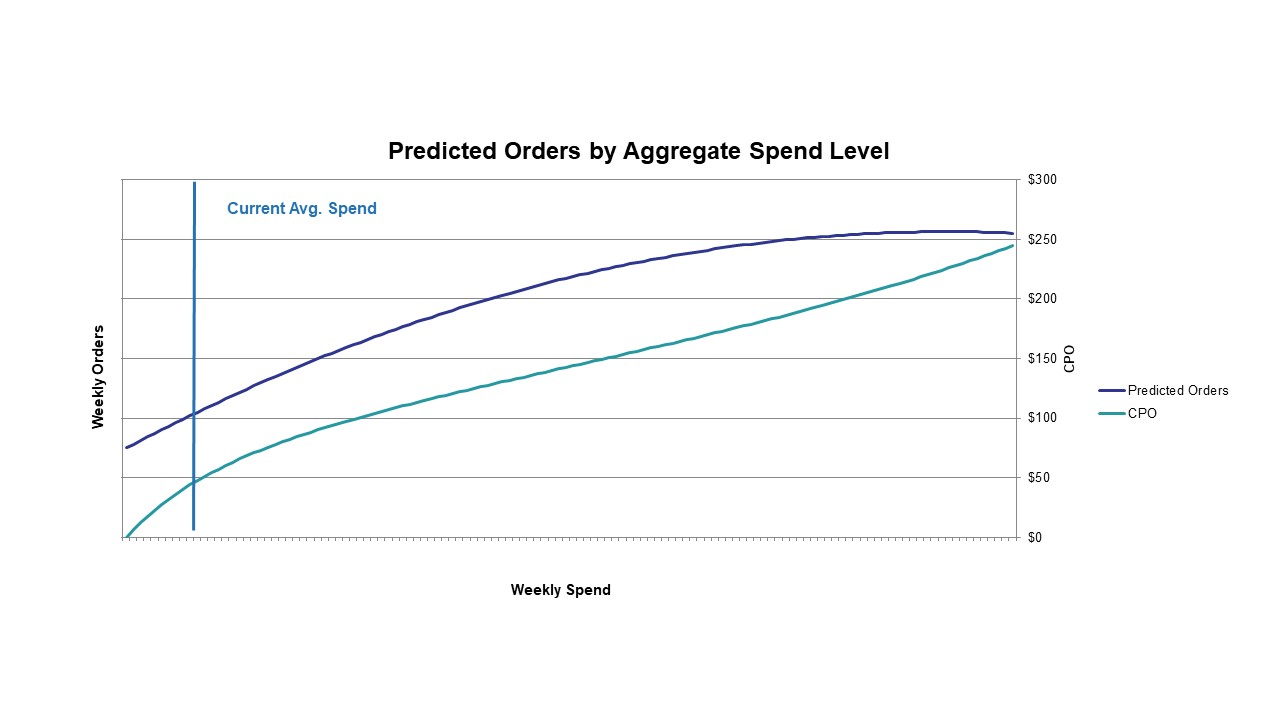

The econometric modeling enabled forecasts of digital subscription sales under different marketing levels and the effective cost per order (CPO) for incremental sales. A chart of the weekly digital starts and the CPO by marketing spend level illustrates how CPO increases due to diminishing marginal effects of marketing. Also, digital subscription starts are observed to plateau above a certain marketing spend.

Figure 2: Predicted Orders by Aggregate Spend Level

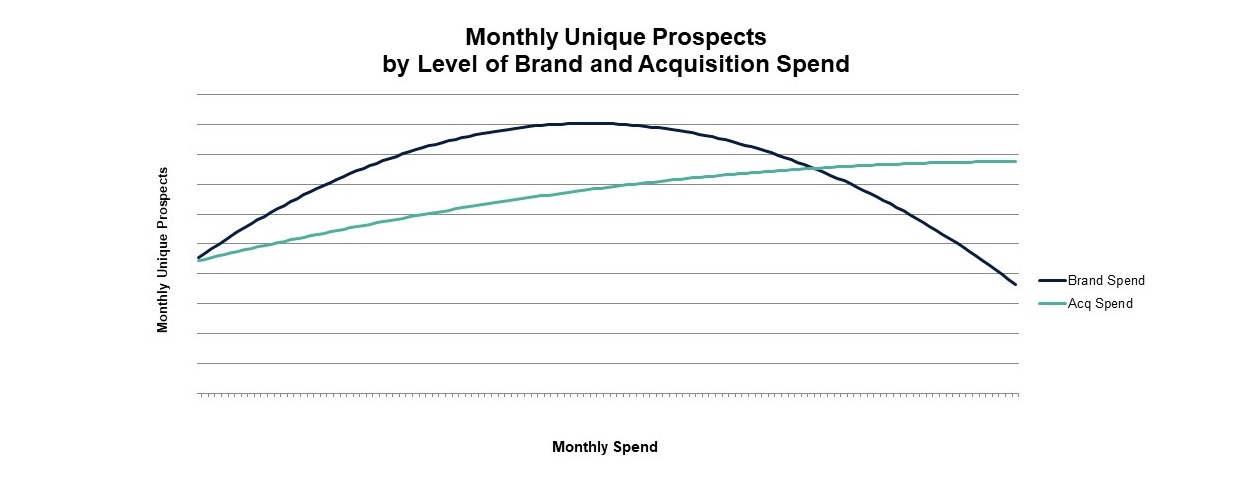

The variation in marginal effectiveness for brand and acquisition marketing leads to a varying optimal mix of the two categories as marketing spend increases. The chart below indicates that brand marketing reaches is maximum effectiveness earlier than acquisition campaigns.

Figure 3: Monthly Unique Prospects by Level of Brand and Acquisition Spend

Acquisition campaigns appear to help with retention

Working with publishers to optimize total subscription revenue, we have observed that digital starts and print retention are positively correlated, which appears to be counter-intuitive initially. If digital subscriptions were a substitute to print subscriptions, we would expect these two metrics to move in opposite directions, with digital starts increasing the number print stops, but that is not what we found.

We believe that digital subscription acquisition campaigns also serve to promote the brand to existing print subscribers, which increases their retention. Thus, the ROI from digital subscription marketing spend includes a retention effect on current subscribers.

This insight reinforces other findings where digital and print subscriptions are complementary products. Where we have the data to track subscribers across products, the rate of transition from digital to print subscription products is typically about 0.1% per week, which is a small effect on overall subscription revenue. In addition, we observe many print subscription sales on digital sales channels.

Conclusions

Different types of marketing are important for maximizing subscription revenue due to its effect on customer acquisition and retention. Our recent work finds that acquisition marketing spend has retention effects on current print and digital subscribers, which should be included in the return-on-investment calculations from marketing campaigns. Brand awareness spend also positively affects acquisition campaign performance and existing subscriber retention. The optimal mix of acquisition and brand awareness campaigns depends on the level of marketing spend occurring for a publisher, but generally we find that news media companies should invest more in brand building than they are currently.

To understand the real impact of your marketing dollars across multiple channels, connect with an expert at Mather Economics.

Here’s an overview of how media mix modeling and how businesses can use analytics to drive smarter ad spend decisions. DOWNLOAD NOW.