By Matt Lindsay

November 1, 2020

Digital subscriber acquisition gets a lot of attention, but the equally important and more difficult task facing publishers is transitioning a legacy print audience to new digital platforms while retaining their profitability.

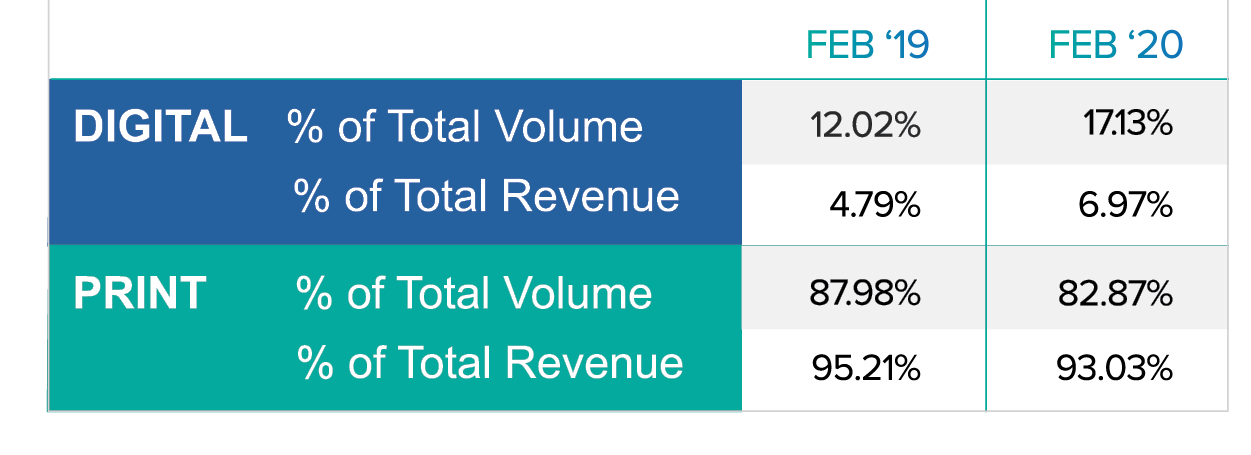

A table demonstrating the strategic importance of a transition plan for migrating audience revenue across platforms is below. In February of 2019, digital subscriptions were 12% of the total, but they were only 4.8% of the revenue. In February of 2020, digital subscriptions had moved to 17% of total volume and 7% of revenue.

As more publishers consider reducing print frequency, a plan to transition print readers to digital platforms while retaining as much revenue and profit as possible is vital.

We find that many digital subscribers were former print subscribers that stopped and restarted their relationship with the publisher, usually at a much lower and less profitable subscription price. The trends of higher print pricing and lower priced digital subscription offers has created a growing incentive for highly profitable print subscribers to switch to digital.

A framework for developing a transition plan includes the following steps:

- Measuring profitability for current print subscribers

- Activating as many print readers as possible on digital platforms

- Growing digital engagement with activated print subscribers

- Identifying print readers likely to accept reduced print frequency plus digital access products

- Determining the ‘next best action’ for a subscriber in their customer lifecycle

Who is profitable?

Calculating a customer’s lifetime value is the first step in developing a transition plan. Examples of customer lifetime value (CLV) for a North American publisher are presented in the tables below. The first table is for a six-day print plus digital access product with the audience stratified by digital engagement. These subscribers have an average weekly rate of $14.96 and five-year lifetime value of US$2,334. The combined costs of newsprint, ink, and delivery costs is $4.70 per week. They have an average operating margin of $10.27.

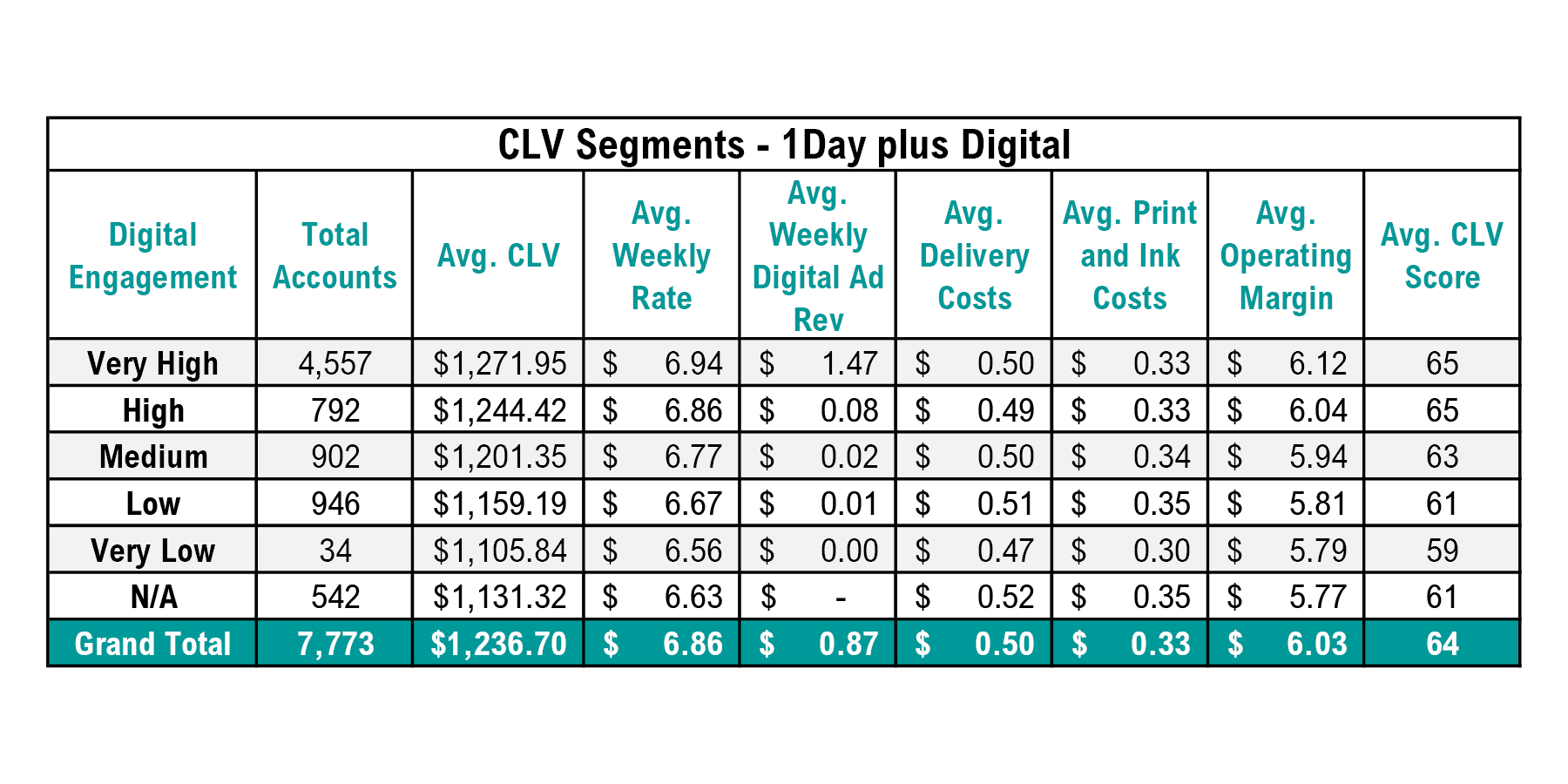

The next table includes CLV for subscribers receiving one day of print plus digital access each week. They have an average weekly subscription price of $6.86, direct costs of $0.83, and a weekly operating margin of $6.03. Their five-year CLV is $1,236.70.

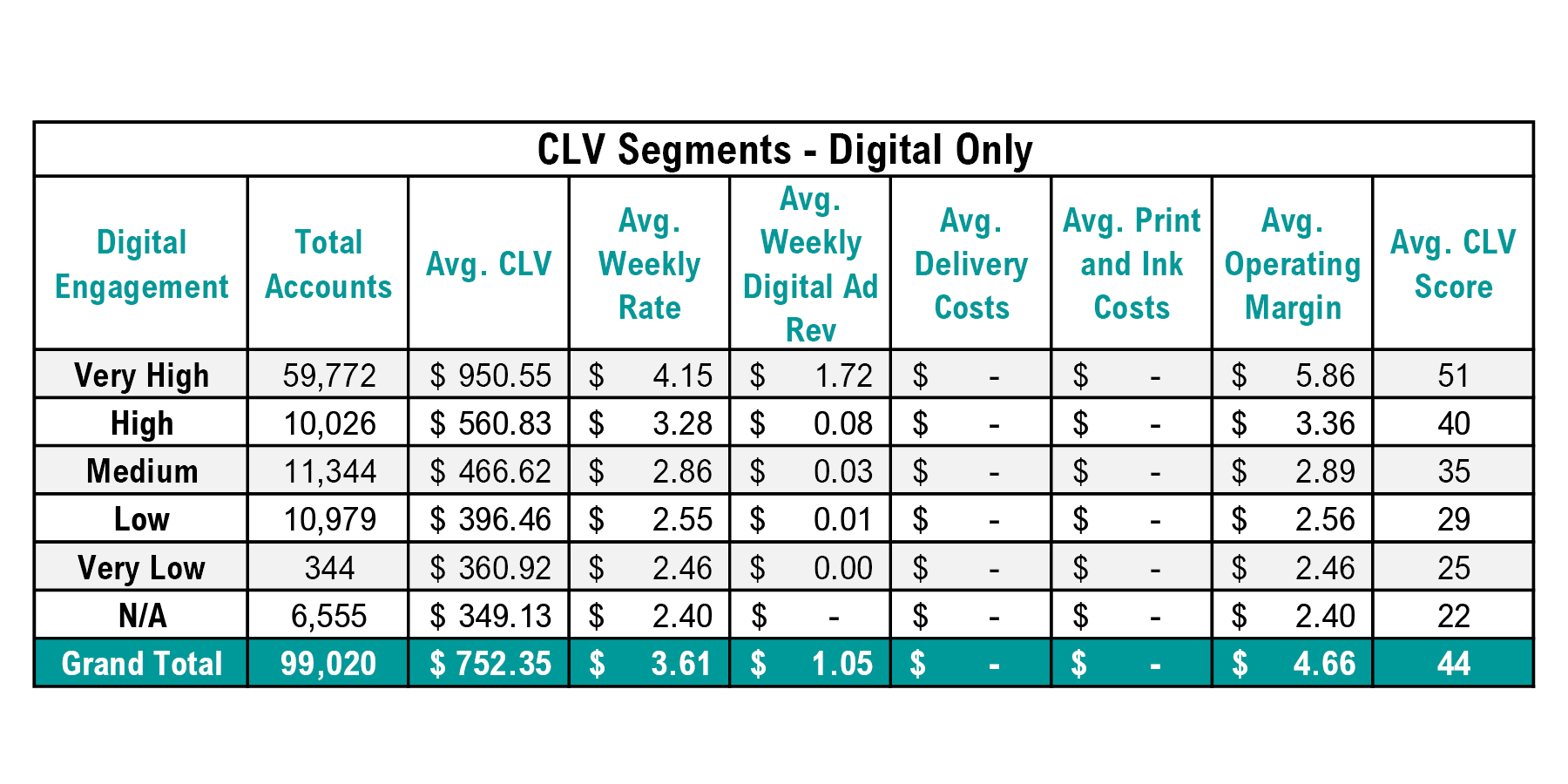

The final table has CLV for digital-only subscribers. They have an average weekly rate of $3.61, and an average operating margin of $4.66 including digital advertising revenue, which was also included in the print plus digital products too. They average five-year CLV for this segment is $752.35.

The variation in CLV for digital only subscribers across engagement levels is noteworthy. The most engaged digital only subscribers have CLV scores that are almost 3 times greater than the lowest segment. The reasons are average rates, with highly engaged digital subscribers paying much more than less engaged readers, digital advertising revenue, and higher retention.

Activate the base

Activating a print subscriber’s digital access is a challenge for many publishers. A few good case studies are emerging on how best to activate print audiences. The Economist has taken as much friction out of the digital activation process as possible for print subscribers. They generate an online account for print subscribers, so they only need to change their password on their first visit.

Offering print subscribers online features and additional content are compelling incentives. Online bill-pay and customer service also will help with activation. Testing tactics, messaging, and incentives is the best process for developing successful processes.

All digital platforms are not alike. Print replica e-editions are most appealing to many print readers. Desktop browsers, mobile apps, and mobile browsers have varying levels of appeal to print readers.

Ready, Set, Engage

Building engagement once a print reader is activated will improve retention probability if print frequency is reduced. Personalization of messaging and recommending content for newsletters help build engagement. Building daily habits is important for daily news organizations. Weekly publications need a more balanced quantity and quality strategy for engagement and retention.

There are many metrics for measuring engagement. Common elements of engagement scores are quantity of content consumed, frequency of online visits, time spent on the site, breadth of content topics consumed, and several others. Finding the metrics that work best for your publication is important.

Keep the profit

Combining CLV with digital engagement enables recommendations for a ‘next best action’ for a print subscriber. Next best action recommendations can be provided to customer service agents in case a subscriber contacts the paper, and they can guide alternative subscription offers to readers at renewal. Most importantly, these ‘next best’ offers can be designed to retain subscribers at price points and print frequency levels that maintain operating margins.

Eventually, digital subscribers will need to pay average rates that yield similar or greater operating margins to print subscribers. Reaching a sustainable digital subscription business model requires not only subscription volumes but subscriber profitability and retaining existing profitable subscribers on new products and platforms is an important part of that journey.

For more information, contact Matt Lindsay at matt@mathereconomics.com.