Mather Economics has completed renewal price tests with several publishers to measure digital-only subscriber price elasticity. To implement these tests, we selected representative samples of digital-only subscribers and moved each group to different renewal prices.

We observed these sample groups for several months and measured the level of stops, customer service calls, and natural attrition. Using these results, an optimal renewal price for the digital-only product was identified, and in most cases this recommended renewal price was higher than expected by publishers.

Sampling is important

Each customer sample was selected to achieve a representative group that had proportional levels of digital engagement, starting price points, income levels, age groups, and other characteristics that are important for predicting price elasticities. The goal of these samples is to measure price elasticity without bias from other factors through comparison with other groups.

There is often a challenge of having enough subscribers for statistical significance. As a result, estimates of price elasticity may not be as precise, with wider confidence intervals, than in other tests. These estimates are still very helpful in developing pricing strategies.

By observing these price test groups over time and analysing the data, it is possible to measure price elasticity across all subscribers and see how price elasticity differs for categories of subscribers. An individual subscriber’s price elasticity depends on his or her specific combination of attributes.

Definition of terms

Price elasticity is synonymous with price sensitivity. Higher price elasticity means subscribers are more likely to stop following an increase. Price elasticity is calculated by taking the ratio of the percentage change in volume over the percentage change in price. If a 1% price increase caused a 1% reduction in customer volume, the price elasticity would be -1, which is equal to the -1% change in volume divided by the 1% increase in price.

Test design

In one test, subscribers who were acquired on a US$0.99 a week digital-only subscription were moved to different renewal price points in US$0.50 increments. One group was renewed at US$1.49 a week, another at US$1.99, a third at US$2.49, and onwards, over the range of prices desired for the test.

The accounts in the test groups were compared to the subscribers who did not receive a price increase. Over the time period of the test, 12% of the no-increase subscribers stopped their service for some reason. Stop rates for each test group that exceeded this level were attributed to the price increase. Across the range of price increases tested, we found the price elasticity of these digital-only subscribers was approximately -.05, meaning that for every 10% increase in price, we would expect 0.5% of subscribers to stop due to the price change.

The number of accounts that contacted customer service and were retained as subscribers but on different prices was proportional to the number of accounts that stopped. We observed an increase in customer service calls of approximately 0.5% for every 10% increase in renewal price. The outcome of these customer service calls was a retained customer on the original price, a price between the original price and the proposed renewal price, or a price below the original price.

An interesting insight from price tests is the variation in customer service representative performance, which can be calculated by measuring call outcomes for each representative.

So, what’s the answer?

To determine the optimal price, we measured the net revenue yielded by these groups after all customer activity was completed, including price stops, customer service activity, and normal attrition. For the customers starting at US$0.99 per week, we found an optimal renewal price of US$3.99. In a similar test of digital-only subscribers beginning at US$2.99 per week, we found the optimal renewal price was US$5.49 per week.

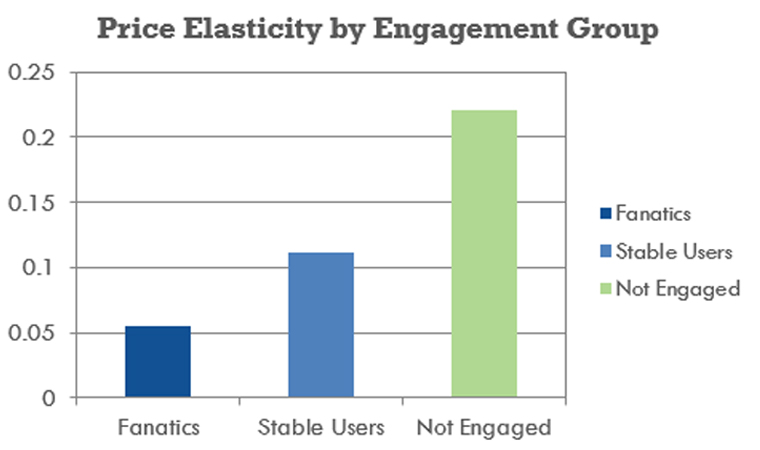

As mentioned earlier, we can summarise price elasticity for different categories of subscribers defined by certain attributes. We find engaged subscribers, defined using levels of reading activity, had price elasticity that was one-quarter the level of non-engaged digital subscribers. We also find subscribers with above-average incomes had about one-quarter the price stops of those subscribers with below-average incomes.

These insights can be verified with other types of analysis and further A/B testing. Econometric modeling is another approach for measuring price responses separate from other factors that affect customer retention. These tests are often useful for regression modeling since they add variation in pricing to the data set.

Some good news

A positive finding from these and other digital-only price tests is that digital-only subscribers engaged with the product are observed to be less sensitive to renewal price changes than print subscribes in the same market. We believe this insight will help publishers grow digital reader revenue through higher price points for digital-only products. Digital subscription revenue does not need to rely on subscription volume to the degree many publishers have originally planned.

Many publishers have acquired and retained digital subscribers for several years and raising prices on these customers without impacting churn is a growing source of incremental revenue. To the degree a publisher is open to a differentiated pricing strategy, where not all customers receive the same renewal price increase, the potential for incremental reader revenue will increase substantially.

Our work with media companies has demonstrated a majority of price stops come from a small group of subscribers, and these digital-only price tests support that conclusion. With these insights, it is possible to identify those customers most at risk for a price stop and proactively extend discounts to them. This tactic often reduces churn following a price increase by 50% or more.

The results described here reflect the markets where these tests were completed. The conclusions are consistent with other tests of digital-only subscribers, but the optimal prices vary by market.