Updated July 22, 2020

By Matt Lindsay, Arvid Tchivzhel, Dustin Tetley and Matthew Lulay

Insights from the Mather Economics’ Listener Data Platform: Data Trends in Engagement, Subscription Performance and Content

MANAGING BUSINESS OPERATIONS

During times of crises, media companies face a dilemma driven by their historical brand and reason for being. Common refrains are:

“My journalistic mission is to serve my community, first and foremost“

“I don’t want to be perceived as capitalizing from a global emergency”

“Now is not the time to think about business, we need to handle the crisis”

Fulfilling the journalistic mission is critical during this time and its relevance should not be understated. However, during difficult economic conditions, taking proactive and thorough action to ensure long-term business sustainability is even more important than before.

Mather Economics is invested in our clients’ success and are committed to supporting our clients. The Great Recession of 2008 informs us that we must prepare, manage the immediate risk, identify opportunity, and act.

These insights can help guide digital revenue management…

BENCHMARK HIGHLIGHTS

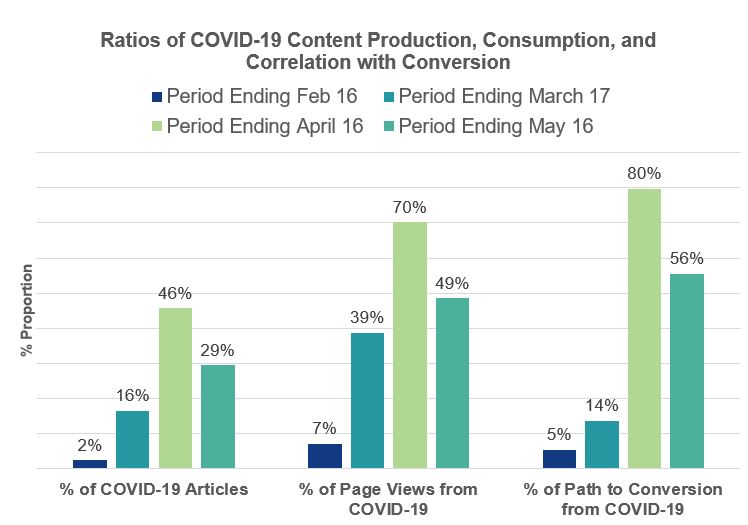

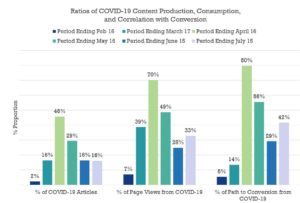

- In the most recent 30-day period, content explicitly tagged as COVID-19 that appears on the path to conversion for new digital subscriptions increased month over month to 42% in July from 29% in June, but it is below the high of 80% during the April period.

- COVID-19 articles produced has stabilized in the last 60 days at 16% of all articles from a high of 46% during the April period.

- We have observed that the impact of COVID-19 content on path to conversion and engagement mirrors the pattern of new COVID-19 cases in the United States and other regions.

INDUSTRY SUBSCRIPTION BENCHMARKS

New conversion growth is past its peak and slowly trending down towards March levels. There continues to be relative growth in subscriptions compared to February. Fanatic and Known users have stabilized since May, suggesting an overall growth in engaged and high propensity users. The number of users hitting the paywall is only 4% higher than February levels, suggesting non-paywall channels are key for subscription growth. The Conversion Rate is improved from the influx of Fanatic users as well, making the paywall more effective.

CONSIDERATIONS FOR THE COMING MONTHS

Risk can be summarized in three areas for the latter half of 2020:

- As expected, conversions and conversion rate have shown decline relative to the peak April months; we expect this to continue to decline unless publishers decided to offer even more attractive discount introductory offers

- Fanatic volume seems to have stabilized for the summer though risk still remains if engagement drops to March levels and reducing the pool of high-propensity users

- New subscribers pose a high churn risk if engagement abates

- There is uncertainty for US publishers with a “second wave” of COVID-19 cases and impact on subscriptions

Key focus areas for the summer months will be:

- Top-funnel and mid-funnel tactics: COVID-19 attracted a high number of new users and engaged existing users enough to migrate them to Fanatics. Apply tactics to reach and push users down the funnel

- Refining new subscriber onboarding series’ and developing targeted retention and pricing tactics based on content preference and engagement level

- Bottom-funnel tactics can be simplified to: keeping a tight meter (or high levels of premium content), experimenting with personalization in the call-to-action, and testing price and its impact on lifetime value

Creative Ideas & Case Studies

Business Rule Recommendations

- Basic and breaking news COVID-19 content remains free though counts towards the meter

- Free registration wall on COVID-19 content to gather email addresses

- In-depth coverage should remain behind the paywall

- Newsletter development and promotion (long-term and breaking news)

- Do not disable the paywall completely from your websites – other content should be left as-is

- Communicate clearly with your audience about your business rules and decision

- Ask users to donate: sponsor a subscription, donate to a good cause, donate to the newspaper

- Reach out to print subscribers and encourage digital activation; the latest news will be in digital form and doing so will help reduce risks and challenges of home delivery

- Use the influx of new users to your site as an opportunity for top-of-funnel and mid-funnel audience development – do not be hesitant to state your editorial decision and value proposition clearly

- For repeat users, encourage them to sample non-COVID-19 content to grow the relationship (via widgets, newsletters, banners, and other calls-to-action)

Click here to download the full presentation

Mather Economics will continue to monitor and publish industry trends, case, studies, and recommendations during the COVID pandemic. We are available for any questions regarding these data or insights. Please contact us at matt@mathereconomics.com or arvid@mathereconomics.com.