INMA Audience Blog

By Matt Lindsay, President of Mather Economics

Why, why, why?

When we work with publishers on pricing strategy, it is quickly apparent that most subscribers do not stop their subscriptions due to price changes. If they are not concerned about the price level, why would a customer stop their subscription? The reason is often the friction in the payment process, such as expired credit card numbers, or a service issue, but the people that contact the paper about a missed paper delivery are often more likely to stay. It could be that they were not engaged with the content during their initial subscription term or that they were convinced to subscribe by an aggressive salesperson. Regardless of the reason, it is possible to “stop the stop” by identifying those customers most likely to cancel and acting quickly.

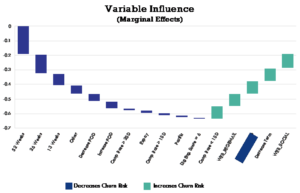

Chart 1: Factors that affect a customer’s probability of stopping their subscription:

In this chart we show the marginal effect of each factor on a customer’s propensity to stop their subscription. Subscription term clearly plays a large role in retention, with longer terms lowering churn risk considerably. A change in the frequency of delivery of the print product is also an important factor, both for increasing the number of days and decreasing them. Factors that increase churn risk include their start source, a reduction in their subscription term, and their acquisition offer price.

We know who you are

The good news is that is it possible to identify those subscribers who are most likely to stop their subscription before the stop happens. Analyzing behavior patterns, such as the timing of payments, enables the recognition of a change in behavior quickly. If they have activated their digital access, a reduction in online activity can be observed, which may indicate they are less engaged with the content and more likely to stop their subscription.

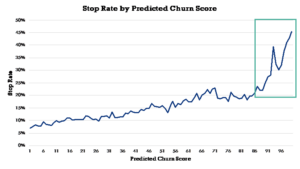

Chart 2: Predicted vs. actual stops

In this chart we have plotted the predicted churn score with the actual stop rate by risk percentile. Those customers who are in the top 15% of churn risk are observed to stop at a far higher rate than other customers. The top 1% of churn risk accounts are observed to stop 45% of the time.

So, what do we do?

It turns out that identifying those customers likely to stop is relatively easy. The challenge is to reduce the likelihood of high-risk customers stopping economically. Giving a customer an expensive incentive to stay may work well, but it is not a sustainable strategy at a large scale. Several publishers are actively testing retention campaigns, and the results are encouraging. Two examples of retention campaigns tests are shared below.

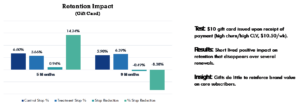

Chart 3: Gift Card case study

A publisher tested giving US$10 gift cards to high-churn risk customers that had a high customer lifetime value (CLV). The chart shows the reduction in stops of the test group relative to a statistically valid control group that did not receive the gift cards. After 5 months, the control group had 6.6% stops while the target group had 5.7%, a reduction in stops of almost 1%, which is a 14.2% improvement. However, after 9 months, the test group had higher stops than the controls. The relatively expensive gift did not have a lasting effect on customer retention on the high-risk group.

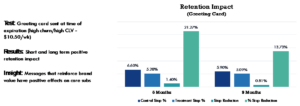

Chart 4: Greeting card case study

The same publisher tested sending thank you cards to high-risk/high-value customers. The low-cost greeting cards had a better short-term effect on retention, lowering stops by 21%, and that effect was observed to sustain over time.

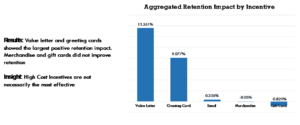

Chart 5: Summary of retention campaigns

This chart shows the retention effect of different campaigns on all customers (including the high-risk/high-CLV groups), and the most effective was a “value letter” sent from the publisher that emphasized the value proposition of the newspaper to the customer. The high cost retention incentives were the least effective in long-term retention improvement.

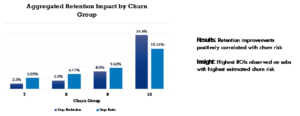

Chart 6: Retention campaign effects by Churn group

The effectiveness of retention campaigns is found to be greatest with high churn-risk customers. Employing an effective churn-risk model and using low-cost retention incentives are important for the return-on-investment (ROI) of retention programs, which are effective in lowering churn among high-risk subscribers.

Saving is cheaper than acquiring

Measuring the effectiveness, cost, and ROI of retention programs is important, particularly as the cost of acquiring customers through traditional sales channels increases. Investing in the retention of existing customers is often a better use of scarce audience development resources than trying to acquire new customers. “A stitch in time saves nine” is a very old expression used by parents to encourage their children to plan ahead. In audience development, a “stop save” in time saves dimes. Many dimes.