Presented by Mather Economics: Matt Lindsay, president; Matthew Lulay, managing director; and Madelin Zwingelberg, senior manager

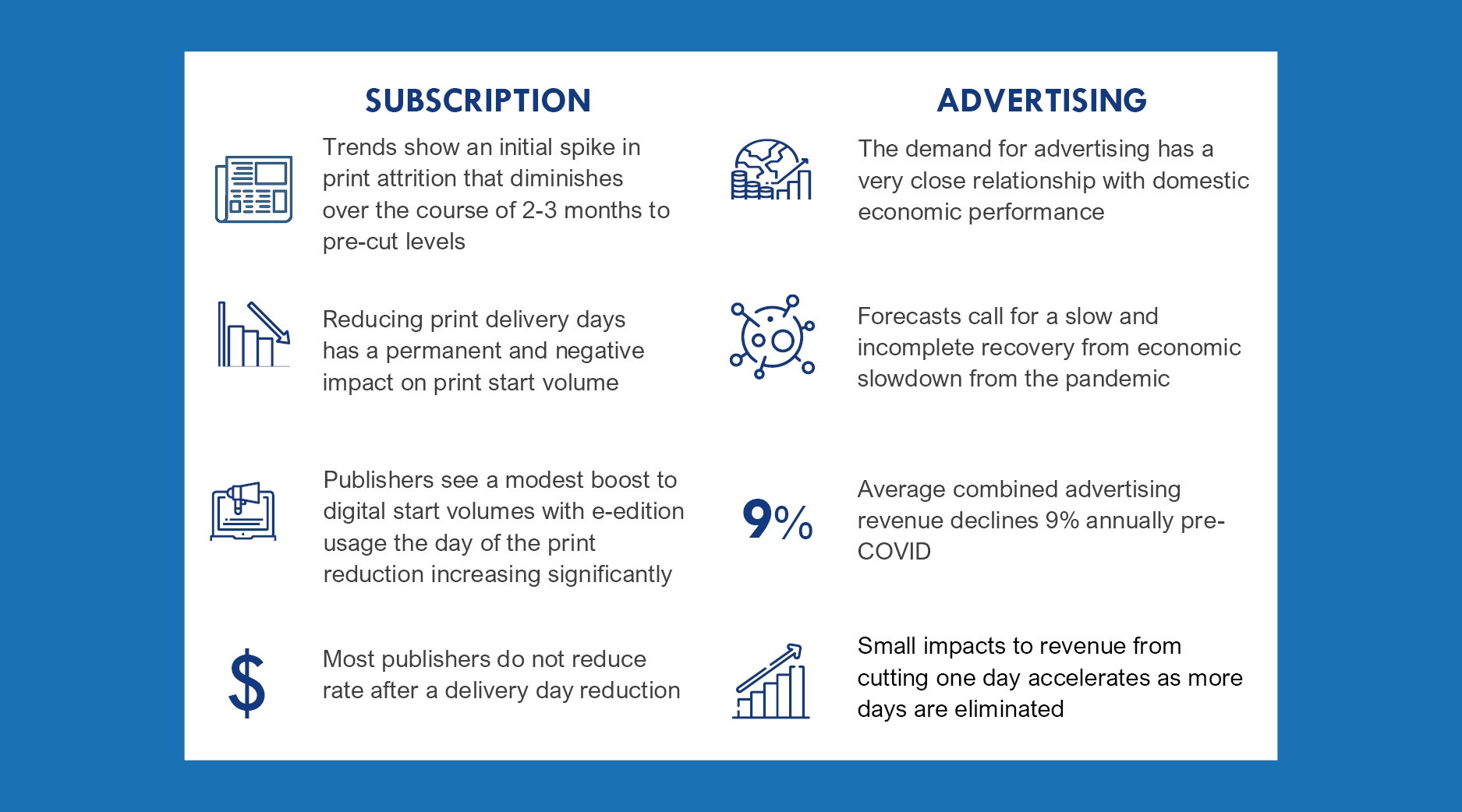

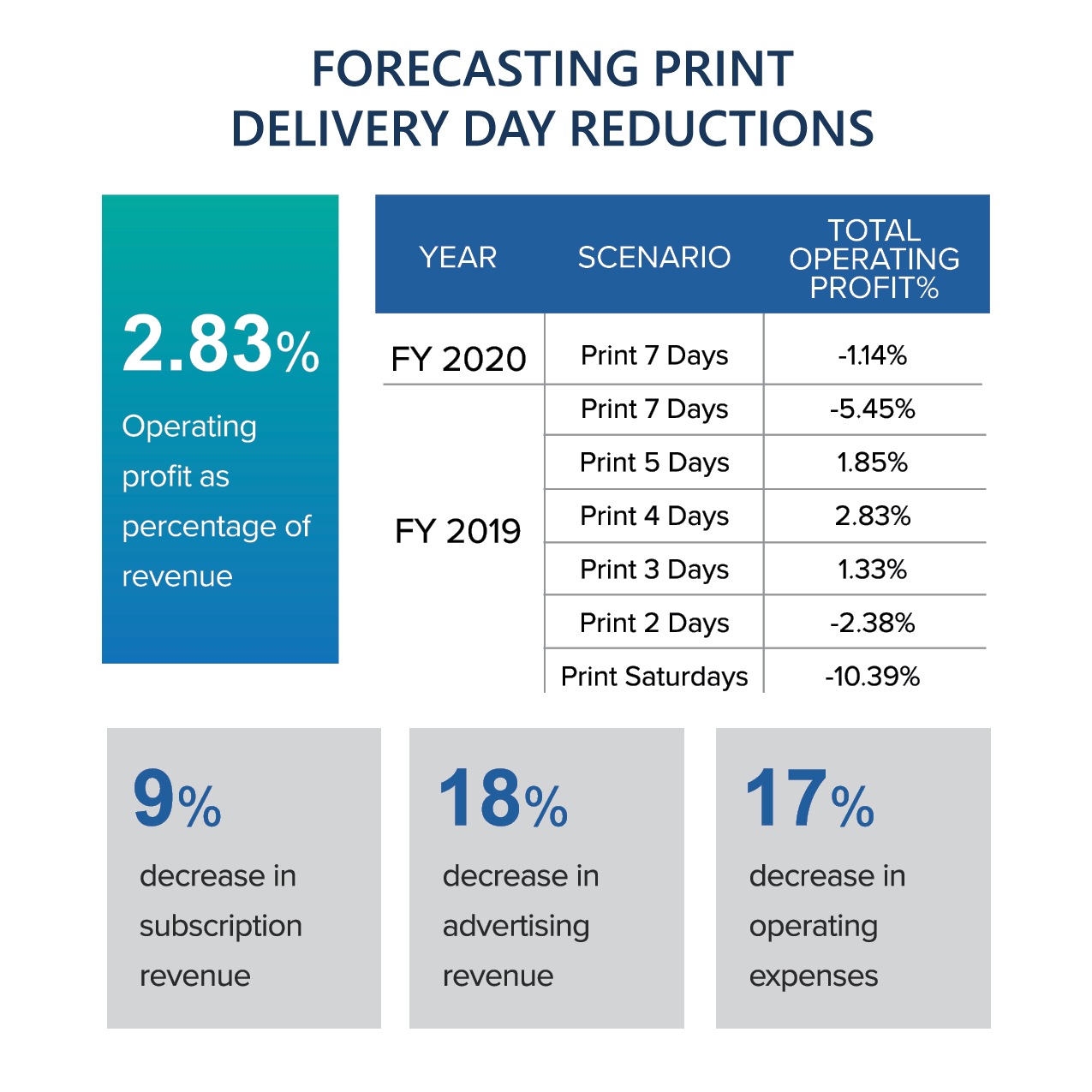

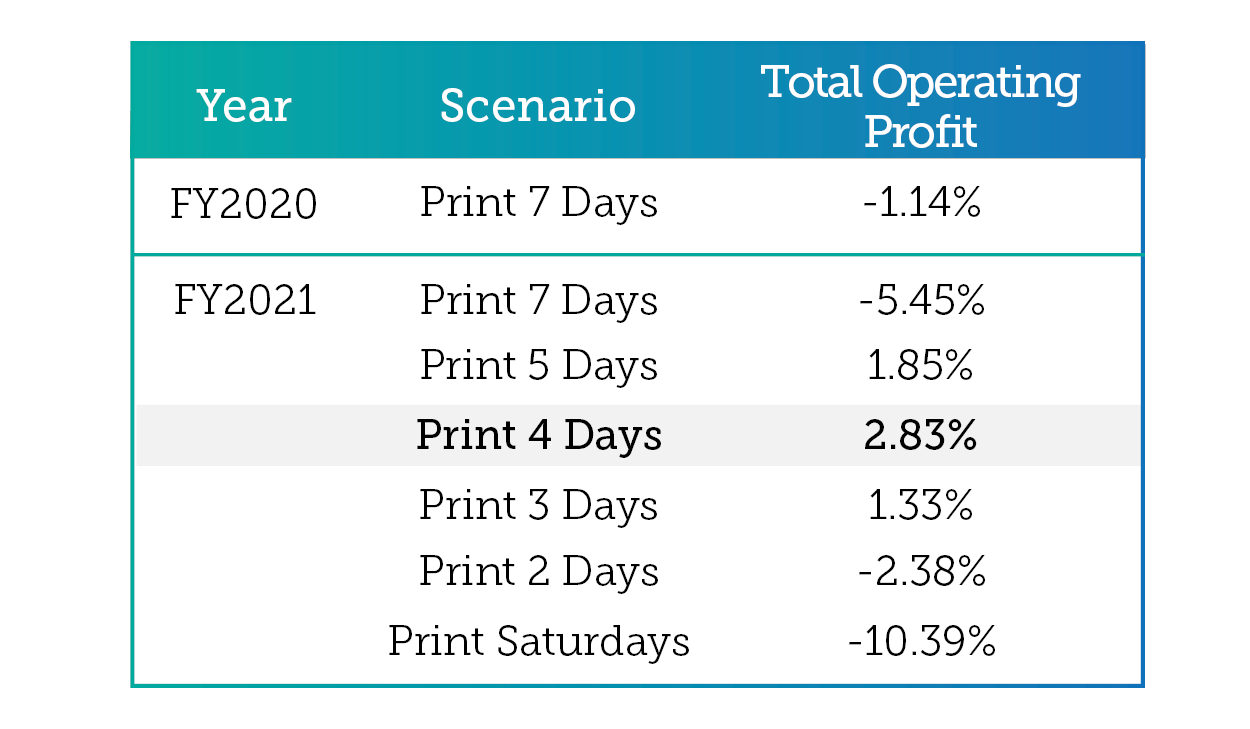

The economics of profitably printing and delivering newspapers has become increasingly challenging, and the COVID-19 pandemic has accelerated the need for publishers to evaluate their business models, including the number of print service days. Most publishers are experiencing double-digit declines in advertising revenue, and the recovery to pre-COVID trends is expected to take a year or more.

During a recent webinar in August, The Mather team helped advise publishers on recouping the lost revenue in savings. They also shared recent case studies on how some of our partners are navigating scenario planning for print delivery day reductions through custom-built subscription and advertising revenue forecasting tools.

Attendees of the webinar asked questions to Mather’s pricing experts. See their questions and advise below.

1| We lowered our print schedule from 7 to 2 days and offered 7-day digital for the same rate they were paying. This was in April and now we are thinking about lowering to 1 print day and keep the rate the same. How do we relay this to the subscribers who already were upset that we went down to 2?

Mather: We think framing these print delivery reductions in the context of making difficult decisions to allow for the continued operation of the publication is an effective communication strategy. Newspapers would like to be in a position to delivery seven days a week, but the economics of doing that have become more and more challenging. Adjusting delivery schedules gives publishers the ability to continue to provide the important service to the community.

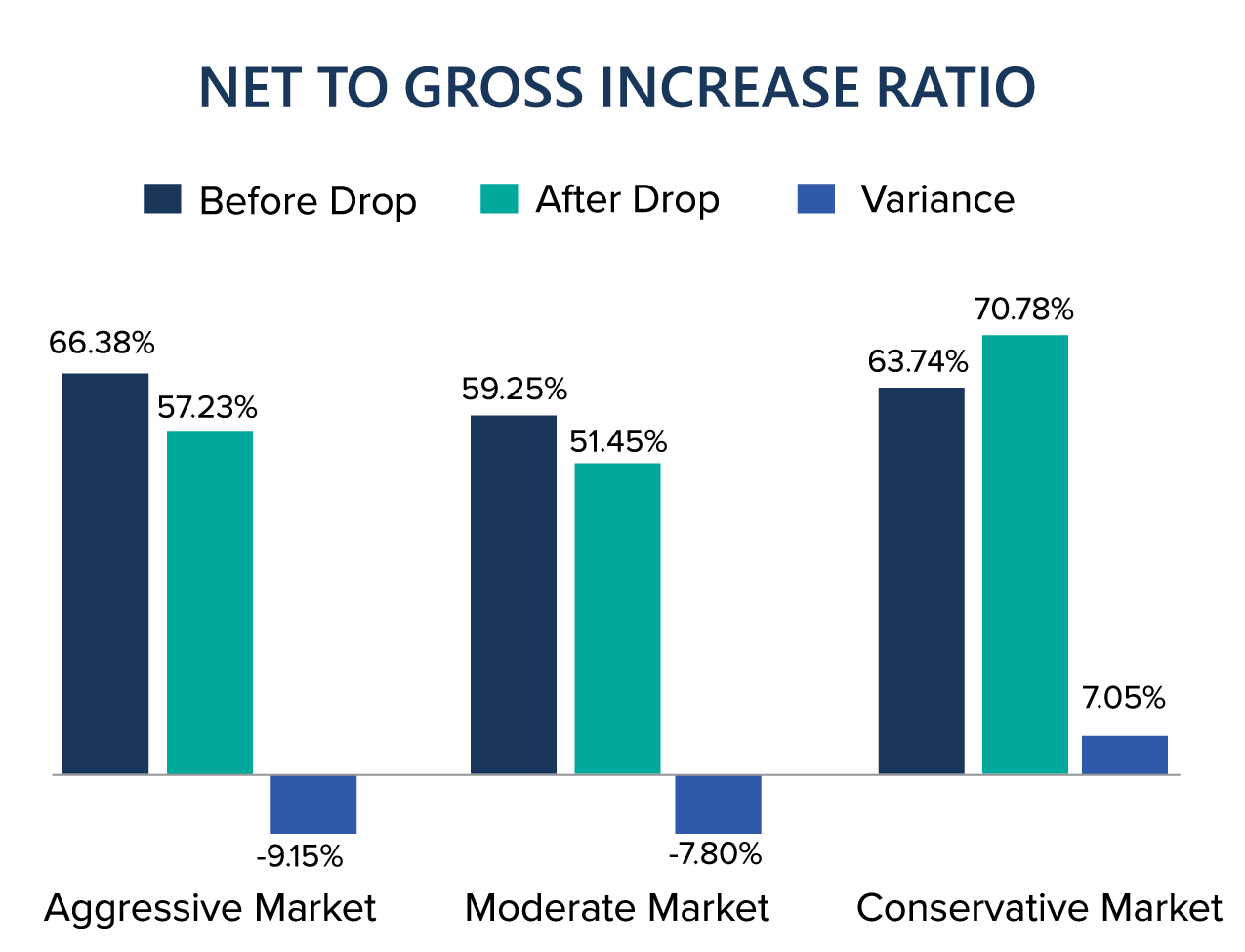

2| Can you define the range of increase % Conservative, Moderate, Aggressive?

Mather: For the data in our chart, conservative is 10% or less, moderate is 10 to 25%, while aggressive is greater than 25%. Each site does 2x per year increases. When applying this to your own market, it’s important to consider the other business rules to determine if you have conservative, moderate or aggressive rules. This is something your primary consultant can help you gauge.

3| Do you have data or advice about dropping from 2 days a week to 1?

Mather: We do not have specific experience with publishers going from 2 days to 1 , but the general framework for evaluating that decision remains the same with forecasting the subscription and advertising revenue impacts along with the expense reductions.

4| Do you have data on how the digital engagement of print subscribers or the digital engagement of the market as a whole effected subscriber attrition and the overall financial effectiveness of dropping days?

Mather: We have heard from our partners that the e-edition usage on the print day(s) dropped increased significantly in the mid double digits.

5| What are some of the value-adds to digital that are resonating among those cutting print publishing days?

Mather: Adding content to the remaining print days, augmenting with a national product, and expanding e-edition features have been effective strategies in adding value to the product while reducing the print footprint.

6| On the subscription side, are you removing day(s) and continuing with price increasing at the same % levels? Is it dependent on the day of the week removed -i.e. weakest print day?

Mather: Most publishers maintain the same price increase before and after the reduction; but some may offset the reduced days by making their business rules more conservative with a longer wait time between increases.

7| Are there any days that were better than others to eliminate?

Mather: Saturdays and Mondays are popular options for print reduction due to the limited impact on advertising. It is important to consider the content in your market that drives engagement on different days of the week to minimize impact on readership.

8| Any specific effects on obituary revenue category?

Mather: Obituaries seem to be a line item that is less affected by print delivery cuts than most since it is not highly dependent on the day of week being inserted.

9| What was the most common # of days eliminated in this data?

Mather: Eliminating one day was the most common in our benchmarks.

10| Are people reducing prices for dropping additional (more than 1) days?

Mather: We haven’t seen this from the markets we polled. The justification of a non-discount approach is by investing heavily into the digital product.

11| What is the average circulation of the newspapers reflected in this data?

Mather: The markets in this database range from less than 2k paid print circulation to greater than 100k.

12| Is there any correlation in the digital advertising revenue and print delivery day reductions?

Mather: We have not seen a major impact on digital advertising revenue with print delivery days dropped, but our benchmarks are slightly limited in that area.

For additional question on print reduction days, reach out to Matthew Lulay or Madelin Zwingelberg.